Market Overview: July 2025

This blog post will cover:

- Fed Meeting – No Surprises

- The GENIUS Act – A New Chapter for Crypto Institutionalization

- The American Crypto Doctrine: Blockchain Dollarization

- Bitcoin Performance in July

- Ethereum Performance in July

- BTC Dominance & ETH/BTC Pair

- Trading Activity & Volume

- Top Gainers & Losers

- Google Trends Analysis

- Market Sentiment in July

- Conclusion

July marked a pivotal month for the crypto market, firmly establishing digital assets as strategic financial instruments. Following a volatile May and a consolidation phase in June, July brought several game-changing developments: the passage of the GENIUS Act, a massive inflow into ETH ETFs, Ethereum’s record-breaking rally, and Bitcoin reaching new all-time highs.

The market didn’t just continue its upward momentum — it began structurally adapting to a new institutional landscape. Crypto is becoming increasingly integrated into the global financial system: the digital dollar is emerging as a foundational infrastructure component, major banks are entering DeFi, and the U.S. has officially pivoted toward supporting stablecoins and Web3.

Unlike previous cycles fueled mostly by sentiment, this rally is backed by fundamental shifts. Strong momentum in BTC and ETH, declining Bitcoin dominance, rising interest in liquid altcoins, and renewed activity on both CEXs and DEXs are laying the groundwork for the continuation of the bull cycle — this time, under a new configuration.

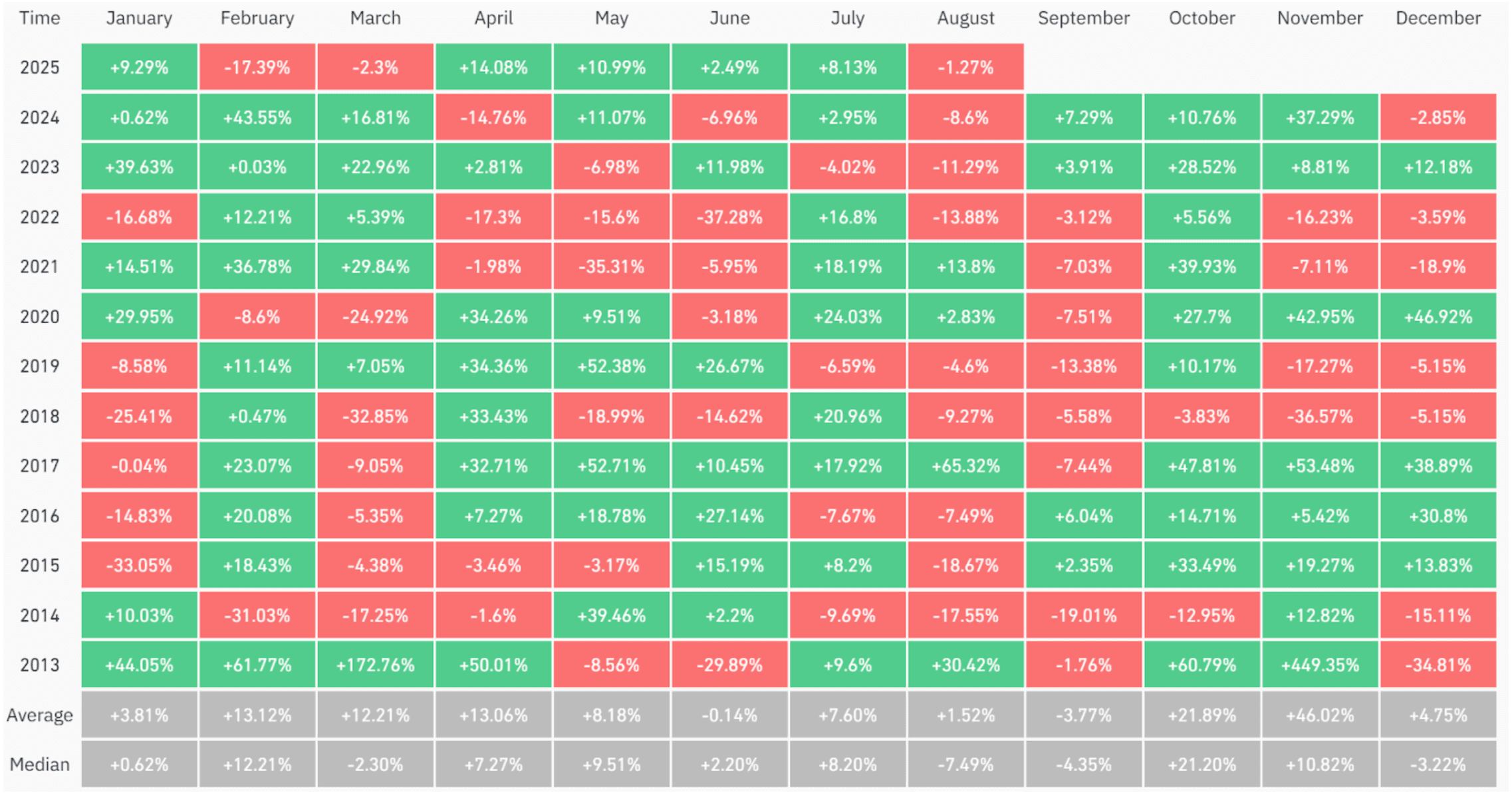

Historically, July has been a favorable month for Bitcoin. Over the past 12 years, BTC has ended July in the green eight times and in the red only four. July 2025 followed this pattern, with Bitcoin gaining over 8%, reinforcing its seasonal trend. This kind of performance, combined with strong fundamentals, boosts investor confidence. Against the backdrop of historical seasonality and growing institutional participation, July further solidified the bullish trend.

Historical BTC Performance | CoinGlass

In this report, we'll take a deep dive into how July reshaped the market, what key forces drove these changes, and what it all means heading into August.

Fed Meeting – No Surprises

The major macroeconomic event in July was the Federal Reserve meeting on the 30th, which delivered no surprises. The federal funds rate was held steady at 4.50%, and market expectations for rate cuts were dialed back to fewer than two by year-end. Jerome Powell emphasized that monetary policy remains moderately restrictive and that decisions will continue to be data-driven.

At the press conference, Powell reiterated that while the U.S. economy remains resilient, growth is slowing, and inflation is still above target. He noted that the long-term impact of tariffs remains uncertain and highlighted unemployment as the key metric to watch.

Overall, the Fed maintained a wait-and-see stance. The central bank intends to complete its monetary policy review by the end of summer and gradually transition toward a neutral stance. Stable interest rates are a neutral factor for BTC, but rising inflation driven by tariffs or geopolitical tensions could enhance Bitcoin’s role as a hedge.

The GENIUS Act – A New Chapter for Crypto Institutionalization

On July 18, Donald Trump signed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins), the first federal legislation to formally legalize stablecoins in the United States. Trump called it the greatest fintech revolution since the Internet.

The new law mandates that stablecoin issuers must:

Be fully backed 1:1 by U.S. dollars or short-term Treasuries

Undergo audits and publish financial reports

Comply with KYC/AML regulations

Notably, the right to issue stablecoins is extended beyond crypto-native companies to include banks and other regulated financial institutions. Major players like JPMorgan, Citi, Bank of America, Goldman Sachs, and Morgan Stanley are already preparing for the digital dollar era under these new rules.

What the GENIUS Act changes:

Creates sustained demand for U.S. Treasuries via stablecoin reserves

Enables multinational corporations to settle cross-border payments instantly with zero FX risk

Turns stablecoins into the digital interface of the dollar, replacing SWIFT and Visa — especially relevant in high-inflation economies

Opens the DeFi sector to institutional capital through regulated liquidity pools

Crucially, the law also lays the legal groundwork for:

Automated smart contracts in global trade

Decentralized identity systems

Blockchain-based public services

This is a foundational step toward Web 3.0 in finance.

The GENIUS Act is a decisively bullish signal, aligning the crypto market more closely with the global financial system and unlocking the door for institutional capital.

However, alongside opportunities come risks:

Potential freezing of funds and heightened regulatory oversight

Increased pressure on centralized platforms, reducing user privacy

Private protocols may be pushed into the shadows, and the system’s resilience depends heavily on trust in the U.S. Treasury market

The GENIUS Act inaugurates a new era where the digital dollar becomes an integral part of the crypto ecosystem — not as a rival currency, but as a central infrastructure layer. Cryptocurrencies are no longer experimental — they are being woven into the fabric of the global economy. This isn't just regulatory recognition — it's a strategic pivot. Innovation is no longer occurring around the system but through it.

The American Crypto Doctrine: Blockchain Dollarization

On July 30, the final version of the presidential report “Strengthening American Leadership in Digital Financial Technology” was released, outlining a new strategic direction for the U.S. in the digital asset space. The document sets forth a national objective: to establish the United States as the global hub for crypto innovation and digital finance, countering the growing competitive pressure from other nations.

The report calls for a sharp pivot in crypto policy, including:

A firm stance against CBDCs: The central bank digital dollar (CBDC) is labeled a direct threat to privacy and individual freedom. The report recommends a legislative ban on CBDC issuance in the U.S.

Protection of individual rights: Citizens should have the legal right to self-custody their digital assets and freely conduct peer-to-peer (P2P) transactions without intermediaries.

Transfer of authority over spot crypto markets from the SEC to the CFTC, aiming for a more open, technologically neutral regulatory environment.

A flexible approach to DeFi regulation: Protocols would be assessed based on their degree of centralization, governance structures, and access to user funds.

Support for banking integration: The report advocates for streamlined licensing and explicitly allows banks to engage in digital asset services.

Tax code modernization: It proposes regulatory clarity around staking, mining, wrapped tokens, and recommends banning “wash sale” tax loopholes.

A special emphasis is placed on USD-backed stablecoins, which the report describes as the “digital interface of the dollar” and a key tool of U.S. geo-economic influence. This strategic positioning builds on the momentum of the GENIUS Act. The U.S. isn’t just legalizing crypto — it’s turning dollar-based stablecoins into instruments of global financial expansion.

Together, the GENIUS Act and the Presidential Report are moving the crypto industry out of the regulatory gray zone and into the core of the U.S. economic strategy. Blockchain, DeFi, and stablecoins are no longer operating outside the system — they’re becoming its infrastructure.

This shift opens enormous opportunities for liquidity growth and institutional adoption, but also introduces increased regulatory risk and pressure on privacy-centric protocols.

July 2025 may be remembered as the beginning of blockchain’s financial dollarization — crypto is no longer an alternative system; it’s being woven into the global financial fabric.

Bitcoin Performance in July

In our June report, we noted that while some profit-taking was evident, institutional demand absorbed the sell pressure, validating the strength of the underlying uptrend. The sideways movement at the time resembled a consolidation phase within a larger bullish structure — laying the foundation for continued growth. July confirmed that scenario.

The month opened with a mild pullback, with Bitcoin hitting a local low of $105,100 on July 2. From that level, the price quickly reversed, reaching a new all-time high of $123,200 on July 14. This marked a 17% gain from the monthly low to the peak, and an 8% increase from the monthly open to the close — a strong performance, particularly as BTC is trading at historic highs.

Notably, after hitting its ATH, Bitcoin did not experience a sharp correction, instead entering a consolidation phase for the remainder of the month, fluctuating between $116K and $120K. This type of price action signals a healthy balance between supply and demand, rather than trend exhaustion.

Bitcoin (BTC) Chart. Source: Cryptorank

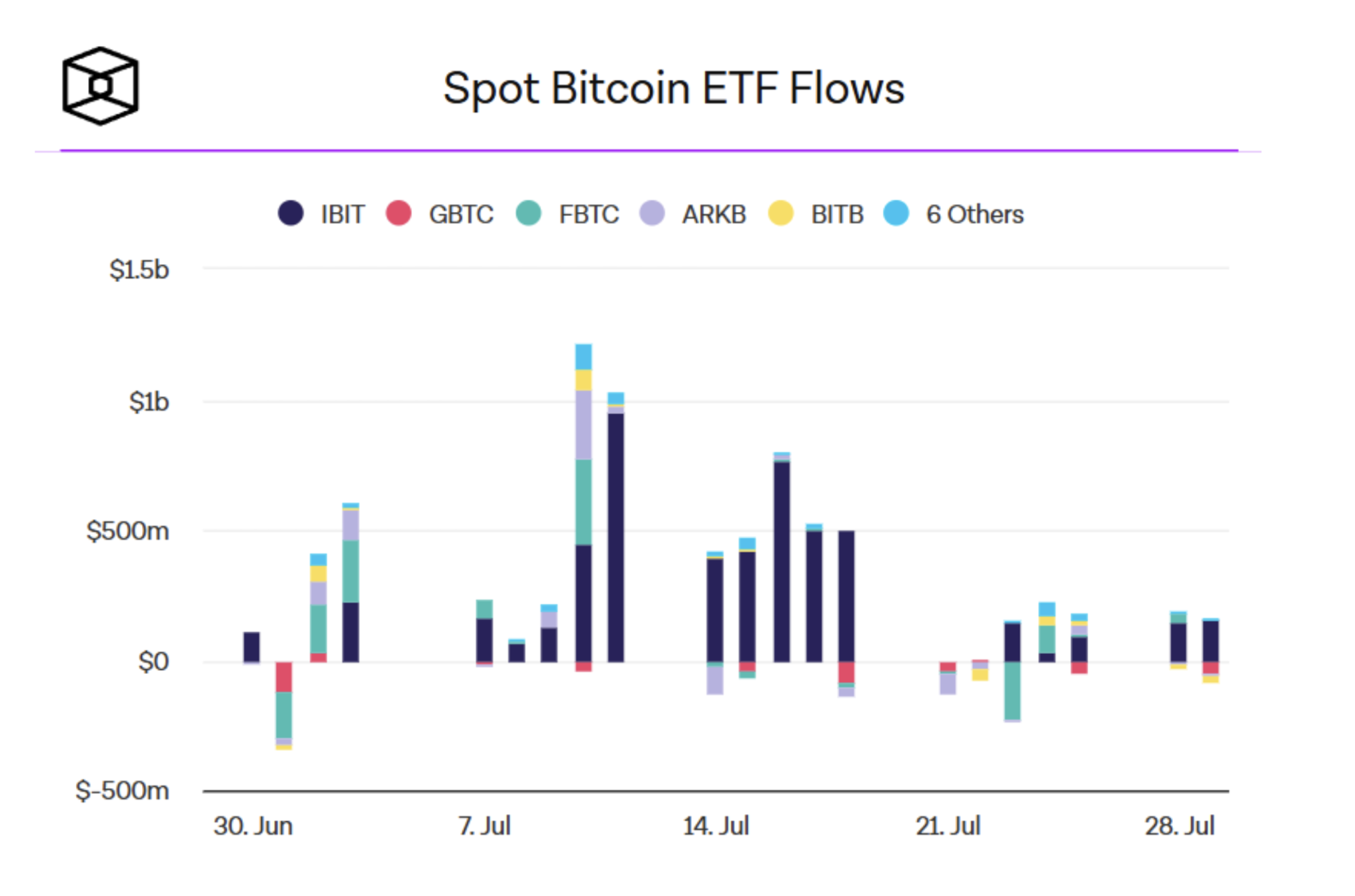

Bitcoin ETF Inflows

A key driver of the current market trend remains the inflows into spot Bitcoin ETFs. In June, inflows hit record highs, mirroring strong accumulation patterns and driving the subsequent price surge. This confirms that institutional demand continues to be a dominant market force.

However, in the second half of July, ETF inflows began to slow, coinciding with Bitcoin’s consolidation. ETF flow histograms reflect this transition — from a phase of aggressive buying to a period of market-wide pause. This isn’t a sign of weakness, but rather a signal of temporary equilibrium, where large players are locking in profits without fully exiting their positions.

These flow dynamics indicate that the market is now in a state of balance between large-scale buyers and sellers, and this balance could shift rapidly. Any change in ETF flow direction — such as a renewed wave of inflows — could trigger another leg up and fresh all-time highs, while outflows might catalyze a corrective move.

Spot Bitcoin ETF Flows. Source: The Block

Ethereum Performance in July

After a quiet, sideways trend in June, Ethereum delivered its strongest monthly performance since 2021. The month opened with a moderate pullback, with ETH dropping from its opening level of $2,484 to a low of $2,367 in the early days. But from that point, the price began a confident climb that quickly turned into a full-fledged breakout.

By mid-July, Ethereum had broken through the $3,000 level, and shortly after, surpassed the key resistance at $3,500. ETH reached a monthly high of $3,940, and closed the month at $3,696. That’s a 49% monthly gain, and a 66% rally from the monthly low to the peak.

Ethereum hasn’t shown this level of strength since the height of the 2021 bull market. In its 10th anniversary month, ETH reminded the market of its role as a technological flagship, capable of matching — even surpassing — Bitcoin in terms of price momentum and investor interest.

Ethereum (ETH) Chart. Source: Cryptorank

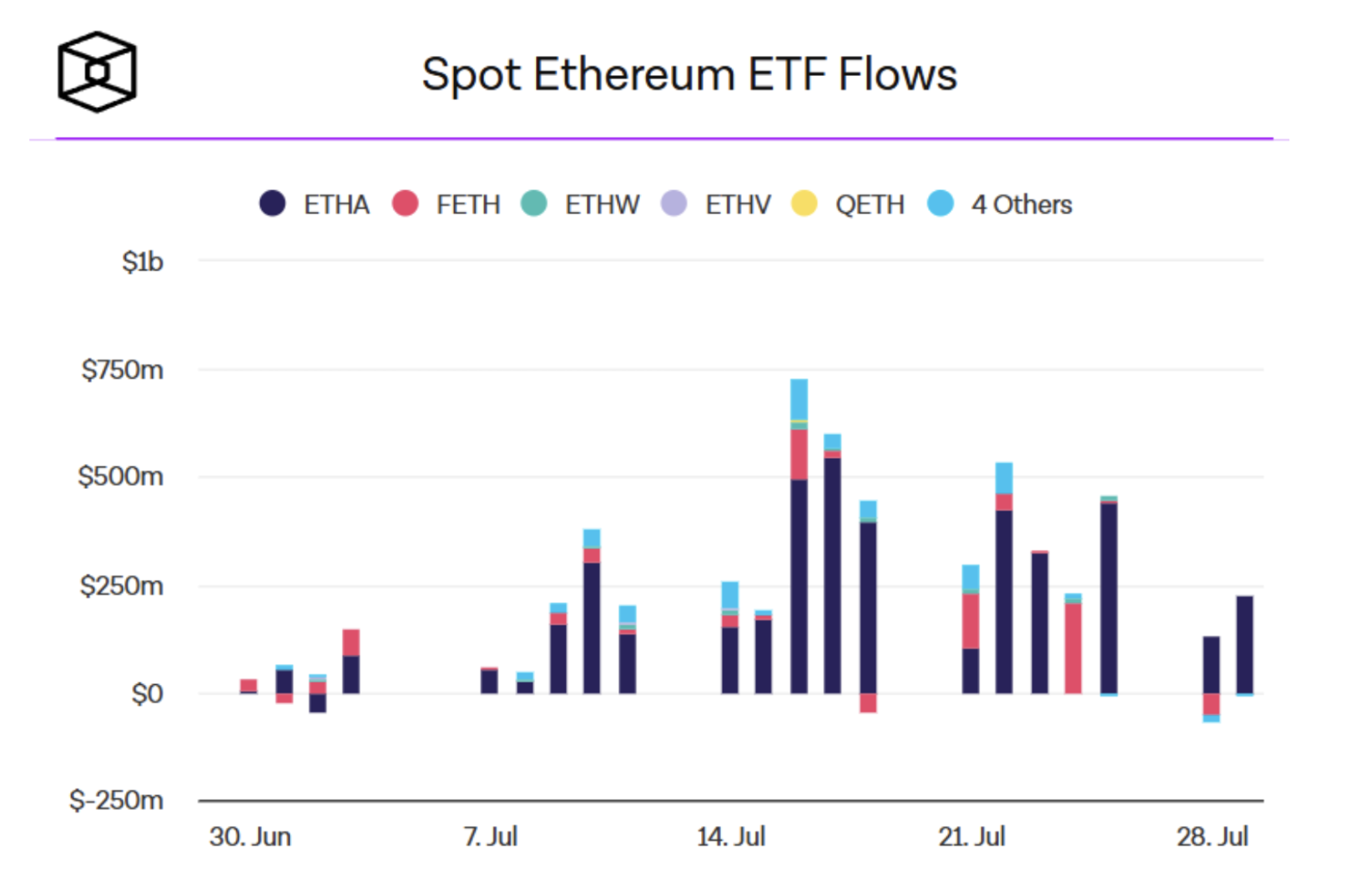

Ethereum ETF Inflows

Like Bitcoin, Ethereum's rally was driven by strong institutional demand, evidenced by major inflows into spot ETH ETFs.

Back in June, we identified persistent ETH-ETF inflows as an early signal of institutional accumulation and confidence. But in July, those flows hit record highs since the ETF’s inception. In the second half of the month, ETH ETF inflows even surpassed those of BTC ETFs — the first time this has occurred since both product classes launched.

The histogram below clearly reflects this shift. Institutions poured into Ethereum, signaling that ETH is no longer viewed as just an altcoin, but rather as the second foundational asset of the crypto market.

This surge in interest is not a one-off event. It sets the stage for a revaluation of Ethereum’s role — not just as a smart contract platform token, but as a yield-generating asset, a collateral backbone, and the core infrastructure for next-gen digital stablecoins.

Spot Ethereum ETF Flows. Source: The Block

BTC Dominance & ETH/BTC Pair

In July, the market began to execute a scenario we outlined in our May report: the rotation from Bitcoin into altcoins following a BTC-led rally. Confirmation came from two key metrics — Bitcoin Dominance (BTC.D) and the ETH/BTC trading pair.

BTC dominance dropped from 65.2% to 61.7%, a clear signal that capital is rotating into assets with higher upside potential as Bitcoin consolidates. The previously identified reversal zone between 64.8% and 67.5% held as expected, and the move now appears to be playing out. A potential target for further BTC.D decline lies in the 48–43% range, a zone that historically has been associated with large-scale altcoin rallies.

Market Cap BTC Dominance. Source: TradingView

In July, Ethereum gained more than 37% against Bitcoin, decisively breaking through key resistance levels and holding above them. This confirms that Ethereum is reclaiming market share and institutional attention, and signals that the broader market is ready to expand beyond BTC.

Historically, rallies in the ETH/BTC pair have been the first signal of a full-scale altcoin rotation, as seen during the bull cycles of 2017 and 2021.

Taken together, BTC Dominance (BTC.D) and ETH/BTC performance confirm a shift in market phase. Capital is beginning to search for returns outside of Bitcoin, and if the current trend continues, altcoin growth could accelerate as early as August or September. In past cycles, similar shifts in ETH/BTC and BTC dominance preceded explosive altcoin rallies.

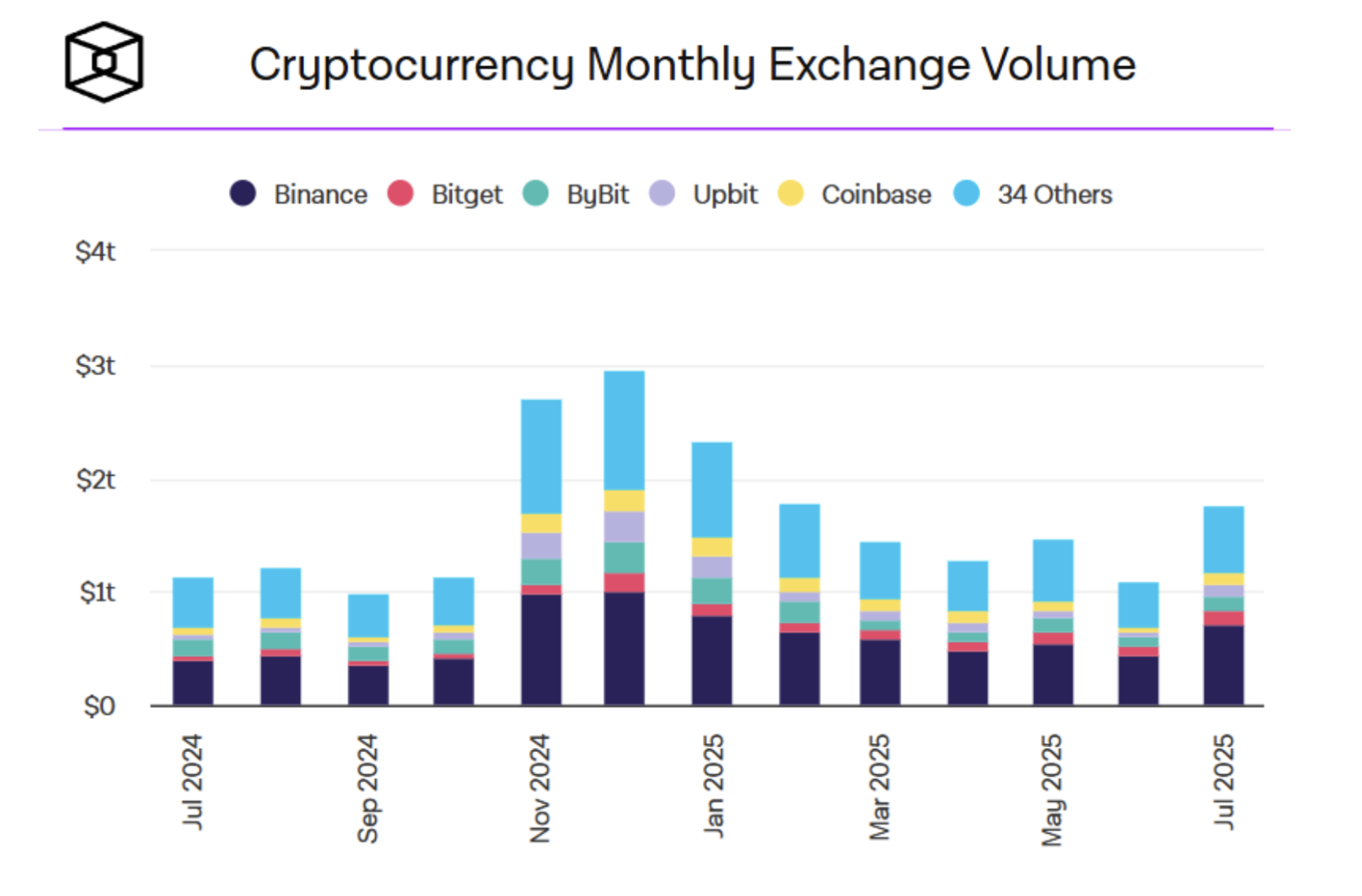

Trading Activity & Volume

After a historically weak June — the worst month of 2025 so far, with CEX spot trading volume dropping to just $1.04 trillion — the market experienced a sharp rebound in July. Total volume surged to $1.77 trillion, a 70% increase month-over-month, and the highest figure in the last four months.

As shown in the histogram below, the usual summer slowdown was broken. July 2025 defied seasonal expectations, becoming an outlier in terms of activity. This shift reflects renewed interest from both retail and institutional participants, fueled by heightened volatility, which acted as a catalyst for active trading.

In short, rising CEX volumes suggest this is not merely a technical bounce, but the start of a sustained phase of market reactivation.

Spot Trading Volume on CEX. Source: The Block

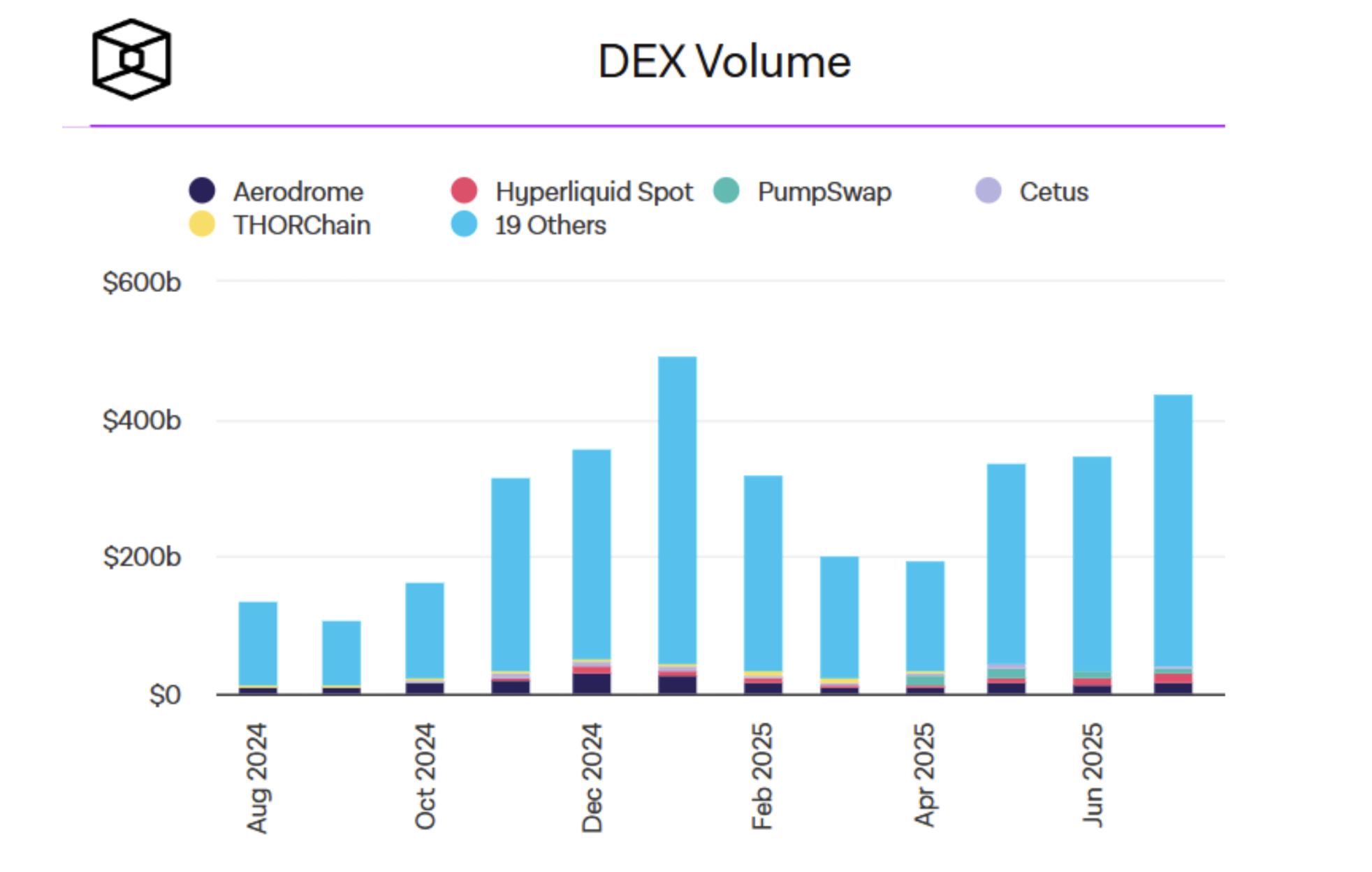

Trading volume on DEXs hit an impressive $437 billion in July, the second-highest figure over the past year. This continued growth reflects a broader market shift toward DeFi protocols. Key drivers include improved user experience, lower fees, faster transaction speeds, and a general strengthening of trust in DeFi infrastructure.

What’s particularly notable is that both DEX and CEX volumes increased simultaneously, signaling not a shift of capital from one to the other, but rather a widespread market reawakening. This suggests a systemic resurgence of interest — from institutional desks to retail traders.

Spot Trading Volume on DEX. Source: The Block

In July, DEXs accounted for 23.35% of CEX spot volume. Although this is a slight dip from June, it's still a significant share, confirming that decentralized exchanges are a resilient and integral part of the crypto infrastructure. Even with CEX volumes climbing, interest in DeFi remains strong — highlighting the market’s maturity and its openness to new financial architectures.

Top Gainers & Losers

July was not dominated by any single sector — altcoins that performed well came from diverse categories, ranging from meme coins to infrastructure protocols. This marks a broadening of capital rotation beyond BTC and ETH and into the wider altcoin market. Notably, four projects posted gains of over 100%, reinforcing the notion that risk appetite is returning, especially in conjunction with ETH’s breakout.

Top Gainers:

Conflux (CFX) +181%: Asia-focused Layer-1 blockchain with legal compatibility in China and partnerships in Web2.

Pudgy Penguins (PENGU) +130%: NFT-native media franchise, with a token linked to its digital and physical products.

Ethena (ENA) +123%: Project behind the algorithmic stablecoin USDe, utilizing delta-neutral yield strategies.

Story Protocol (IP) +102%: A platform for licensing, tokenizing, and monetizing digital content.

Bonk (BONK) +84%: A Solana-based meme coin, previously a major trigger for retail hype.

The sharp rise in CFX signals reinvigorated activity from Asian investors, while ENA’s surge underscores the growing appeal of decentralized stablecoins. Meanwhile, the simultaneous rise of two meme coins suggests a cautious return of retail speculative behavior.

Top Losers:

Pump.fun (PUMP) –57.7%: Meme coin generator platform on Solana; poor token launch.

Pi Network (PI) –18%: Ongoing controversy surrounds this project — more in our blog.

Virtuals Protocol (VIRTUAL) –18%: Gaming/metaverse infrastructure project.

Kaia (KAIA) –9.8%: New entrant in the AI space, yet to gain traction.

Aptos (APT) –6.7%: A major L1 that showed low activity in July.

Importantly, most losers posted only mild declines, indicating broad market resilience. Corrections seem localized to overhyped assets, while liquid altcoins and infrastructure projects remain in focus.

Google Trends Analysis

Google Trends once again proved to be an early indicator of investor attention. Historically, assets trending in searches often see increased volatility and upward movement shortly after. Examples include past spikes in FARTCOIN and HYPE. Ethereum, which topped June’s search trends, ended up as one of July’s top-performing large-cap assets, gaining over 50%.

In July, search interest was concentrated on familiar, liquid tokens in the top 20, such as BTC, DOGE, AVAX, and XRP. This pattern suggests that investors are currently gravitating toward recognized assets in anticipation of the next major impulse.

Notably, DOGE and AVAX appear well-positioned to benefit from any capital rotation following ETH's rally. The lack of new meme coins in trending searches, combined with ETH’s dominance, indicates that the market may be in a recalibration phase, preparing for the next retail-driven wave.

Overall, retail interest in July was measured and focused on trusted names, providing a solid base for continued growth. Google Trends remains a reliable, predictive tool for gauging early-stage investor sentiment.

Market Sentiment in July

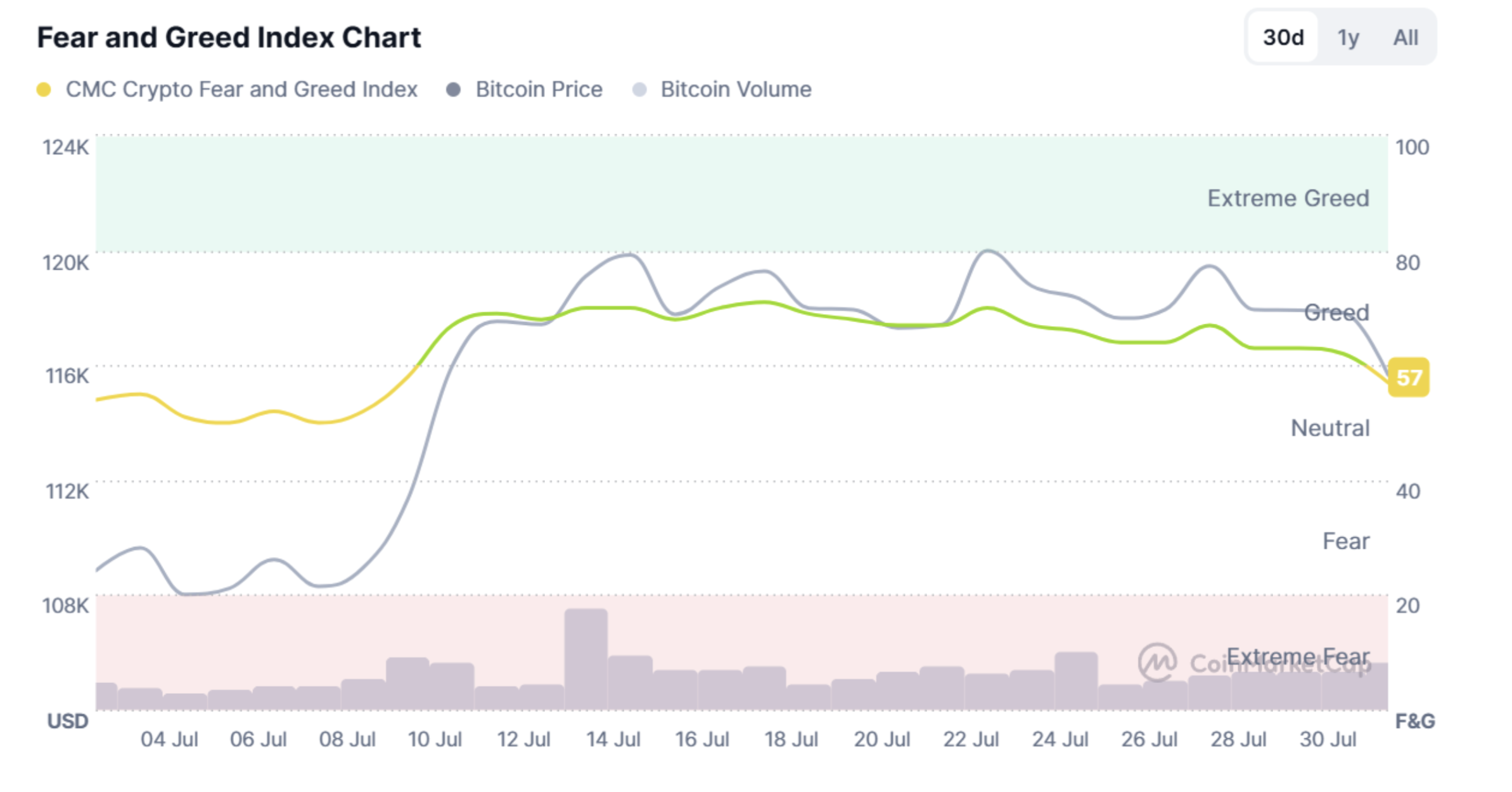

June’s neutral sentiment cooled off the market after May’s surge, creating a solid foundation for future moves. July confirmed this stabilization. The Fear & Greed Index remained mostly in the greed zone, but never hit euphoric extremes. This measured optimism was accompanied by strong performances in Bitcoin and especially Ethereum, without triggering a retail frenzy.

This restraint is a hallmark of the current cycle: the market is rising, but emotions remain in check. Indicators point to mild overheating, but with ETF flows driven mostly by institutional accumulation, we are far from full-blown FOMO.

Toward the end of the month, the index returned closer to neutral, signaling ongoing caution. July was a natural continuation of June’s consolidation, as traders gradually shifted from sideline-watching to moderate risk-taking, but euphoria is still distant. This creates a psychologically healthy base for further sustainable growth.

Fear and Greed Index. Source: CoinMarketCap

Conclusion

July 2025 was a turning point — not just in price action, but in infrastructure and institutional engagement. The passage of the GENIUS Act and the release of the presidential crypto doctrine cemented the U.S. shift toward embracing digital assets as a strategic priority. This added clarity and confidence to the market. Capital isn’t just returning — it’s doing so with long-term, institutional intentions.

Bitcoin set a new all-time high

Ethereum posted its strongest rally since 2021

CEX and DEX volumes surged

Altcoin activity picked up across sectors

Sentiment remained stable and controlled

From May’s market reboot to June’s stabilization, July marked a structural pivot. Strong institutional demand, ETH leadership, and capital rotation toward altcoins are laying a solid foundation for continued growth.

And this is before factoring in the potential approval of ETH staking within ETFs — a development that could transform ETH into a yield-bearing, institutional-grade asset. As noted in our Ethereum’s 10-year anniversary article, ETF-based staking could significantly boost demand and position ETH as a core revenue-generating component of future finance.

If August confirms these signals, the entire crypto market could enter a new growth phase. Risks remain — geopolitical uncertainty, ETF flow fluctuations, and mild greed levels could temporarily slow momentum. But the base case remains bullish, supported by fundamentals, policy, and positioning.

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.