What Is Liquidation in Crypto? How to Liquidate Assets and Avoid Forced Liquidation

This blog post will cover:

- Introduction to Crypto Liquidations

- Core Concepts: Liquidation, Forced Liquidation & Voluntary Asset Liquidation

- What Is Forced Liquidation

- Liquidation in DeFi

- How to Liquidate Assets Voluntarily with SimpleSwap

- Actionable Tactics to Avoid Forced Liquidation

- Calculating & Monitoring Your Liquidation Price

- Common Misconceptions

- What to Do If You’re Near Liquidation

- FAQs

- Glossary

Introduction to Crypto Liquidations

What does liquidating assets mean? But before we dive into these definitions, tools, and tactics, that are used to liquidate assets and more, let’s start with a scene every crypto trader recognizes: price rips 3% up, snaps 5% down in seconds, spreads widen, and your stop hasn’t fired – yet your position gets closed anyway. That’s liquidation risk in a market built on volatility and leverage.

This guide gives you a three-part edge: first, understand how liquidation (more precisely liquidation in crypto) actually works (mark price, maintenance margin, backstops); second, avoid forced liquidation with concrete, repeatable risk practices; and third, act on your plan – including how to voluntarily liquidate into stable value via SimpleSwap when conditions change.

This educational content is for information only and does not constitute financial advice. Trading crypto derivatives carries significant risk, including the risk of loss.

Why This Guide Matters Now

Whipsaw moves are normal in crypto, and leverage is easier to access than ever. That mix makes liquidation risk immediate – even for small positions. This article is an overview of crypto liquidations: you’ll see why most liquidations are triggered by the mark price, how maintenance margin is the line you can’t cross, and how to avoid forced liquidation with sizing, alerts, and early adjustments.

We’ll also show you when it’s smarter to liquidate voluntarily (rotate into stablecoins) using a non-custodial swap so you control the exit, not the engine.

Core Concepts: Liquidation, Forced Liquidation & Voluntary Asset Liquidation

So, what does it mean to liquidate assets? Before we get tactical, pin down the meanings. Clear terms make for clear decisions. With that foundation, the rest of the guide will click into place.

What is Liquidation in Crypto

In crypto, liquidation has two distinct meanings.

Forced liquidation happens on margin or derivatives platforms when your account equity drops below the maintenance margin. The venue liquidates some or all of the position – usually based on the mark price – to prevent the account from going negative. You’ll see terms like bankruptcy price or zero-equity level that describe where positions are closed if liquidation begins.

Voluntary liquidation is when you convert assets to “cash-like” value – often stablecoins or fiat equivalents – to realize gains or cap downside. Unlike forced liquidation, you choose the timing, destination, and method (for example, swapping volatile coins to USDT/USDC via a non-custodial exchange flow). In short: forced liquidation lives in derivatives, while voluntary liquidation is common in spot and portfolio rebalancing.

Long vs short liquidation (crypto-specific): A long liquidation occurs when price falls, forcing closure of long positions that bet on an uptrend. A short liquidation occurs when price rises, forcing closure of short positions that bet on a decline. Both are mechanical, margin-driven events – the direction just flips with your position.

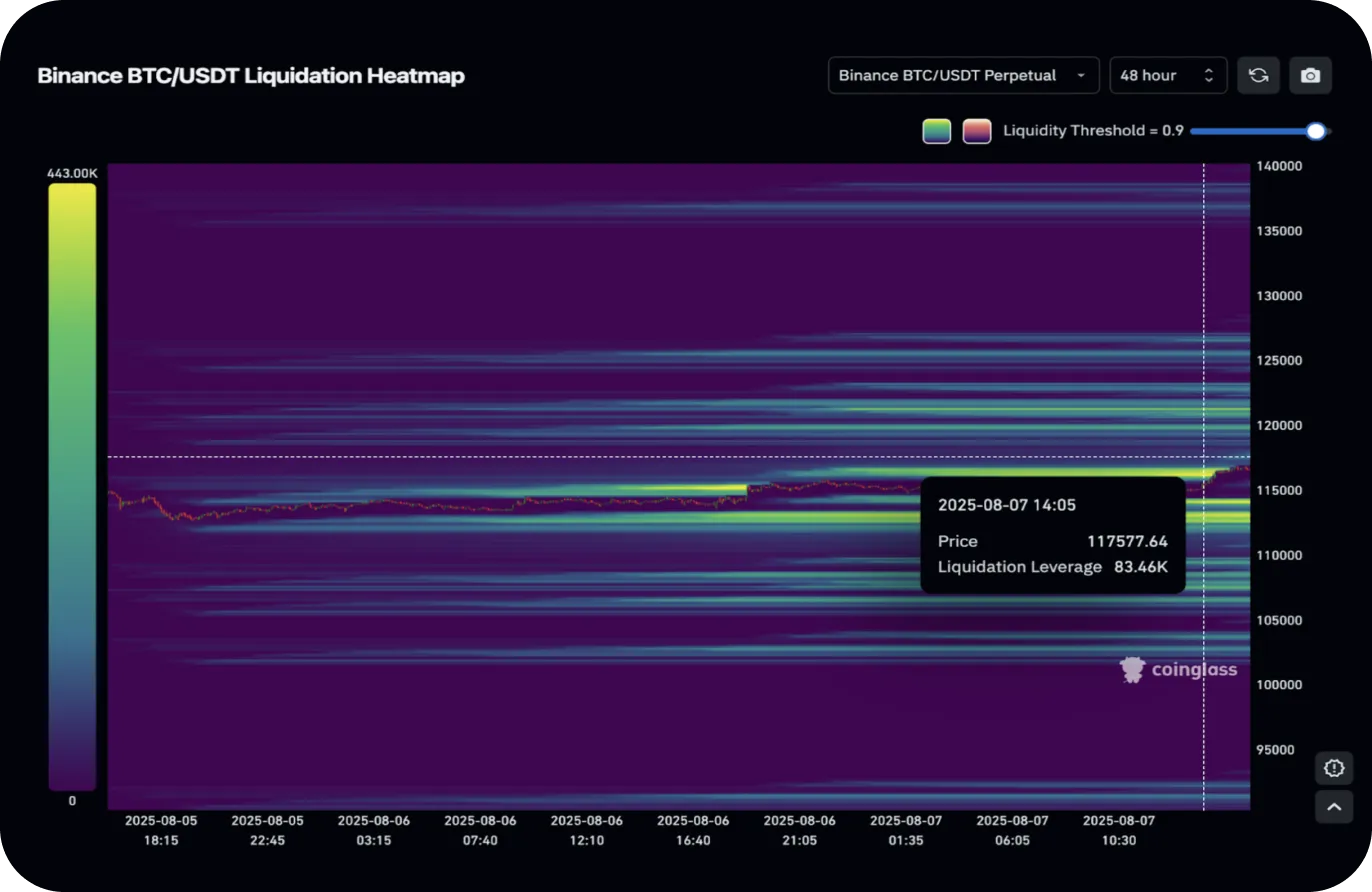

Liquidation heatmaps & “cascades”: Tools like CoinGlass visualize where large clusters of leveraged positions may be forced to close.

Source: https://www.coinglass.com/pro/futures/LiquidationHeatMapModel3

When price tags those levels, a rush of liquidations can add momentum – sometimes forming a liquidation cascade that moves price further into the cluster before stabilizing. Use these visuals to understand crowded levels, not to assume inevitability.

The Mark Price vs Last Price

Most crypto derivatives venues trigger liquidation on the mark price, not the last trade. The mark price blends an index of spot prices across multiple exchanges (and sometimes a basis component) to dampen the effect of thin order books or isolated prints. The last price is simply the most recent trade on that venue.

Example: last price dips to $29,950 on a thin wick, but the mark price – derived from broader market data – sits at $30,050. If your liquidation is at $30,000, your stop keyed to last price might not execute before liquidation based on mark. The system cares about marks, so you can be closed even though your stop didn’t fill.

Direction matters only by position side: if the mark falls to your long’s liquidation level, you face a long liquidation; if the mark rises to your short’s liquidation level, you face a short liquidation. Either way, the reference is the mark price – not the last tick.

What Is Forced Liquidation

Now that the terms are clear, let’s look under the hood of centralized futures and margin platforms. The mechanics are similar across venues, with differences in thresholds and backstops.

Maintenance Margin & Liquidation Thresholds

Every derivatives venue sets a maintenance margin – the minimum equity needed to keep a position open. When your margin ratio reaches a critical threshold (often framed as Maintenance Margin ÷ Margin Balance), the liquidation process begins. You can try to avoid it by adding margin or reducing size before the trigger.

Margin mode shapes risk. In cross margin, all positions share one collateral pool, so a loss in one can drain equity for others. In isolated margin, each position has a dedicated buffer; a blow-up in one won’t auto-drain the rest. Beginners typically prefer isolated to ring-fence risk; advanced traders might use cross for capital efficiency – accepting correlated exposure.

Think of liquidation thresholds as sliding with leverage and size. Higher leverage narrows your “distance” to maintenance margin; small adverse moves become existential. Exchanges publish tables or calculators showing where your liquidation price likely sits given position size, entry, fee model, and margin mode. Monitoring that figure – and the mark price it’s keyed to – is essential day to day.

Partial Liquidation And Risk Backstops

Many platforms don’t instantly close your entire position. They attempt partial liquidation first: trimming size to raise your margin ratio above the danger line. If the market keeps moving against you and the system can’t fully close at or above the bankruptcy price, venues may tap insurance funds to absorb residual losses.

When funds are insufficient or markets are disorderly, Auto-Deleveraging (ADL) can kick in: profitable opposing positions are reduced in a set priority to offset the underwater account – protecting platform solvency. These mechanisms exist to keep the market functioning, not to guarantee individual outcomes.

Mark Price Mechanics In Practice

Why mark price? Using a reference built from an index price (typically a blend from multiple spot exchanges) plus smoothing reduces liquidation due to single-venue manipulation or momentary outages.

In practice: if the mark hits your liquidation level, the engine starts closing you – regardless of the last traded price on that venue. For most traders, that single sentence explains 80% of “surprise” liquidations.

Liquidation in DeFi

Centralized venues aren’t the whole story. Lending protocols secure themselves differently. Here’s the high-level map so you can compare.

Fixed-spread vs Auction-based Liquidations

DeFi liquidations generally follow two models. Fixed-spread (Aave/Compound-style pools) lets liquidators repay a portion of a borrower’s debt and seize collateral at a pre-set discount once the account’s health factor breaches a threshold. It’s simple and fast, but if competition is thin, discounts can bite borrowers harder than necessary.

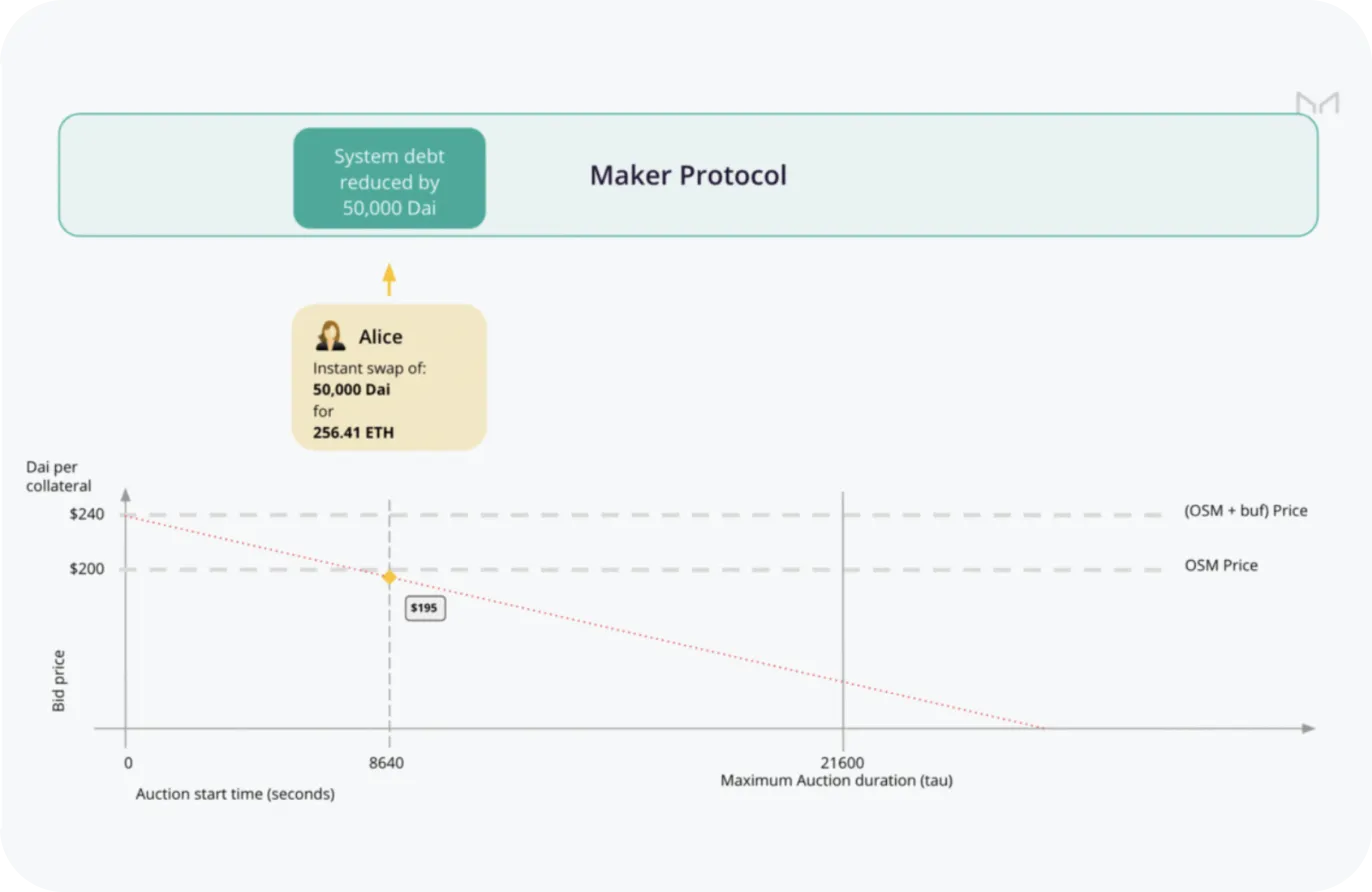

Auction-based systems (MakerDAO) use mechanisms – now Dutch auctions in “Liquidation 2.0” (read more on this module in MakerDAO documentation) – that discover prices over time; with enough bidders, auctions can reduce sudden market shock and potentially yield more efficient outcomes.

Source: https://docs.makerdao.com/smart-contract-modules/dog-and-clipper-detailed-documentation

Recent academic and industry research compares these designs and their spillovers during stress.

How to Liquidate Assets Voluntarily with SimpleSwap

Sometimes the best defense is choosing your exit – calmly and on your timeline. If the path ahead looks shaky, you can rotate into stability without waiting for the engine to decide for you.

When Voluntary Liquidation Makes Sense

If your leverage is high, liquidation risk rises, or your investment thesis changes, voluntary liquidation (e.g., converting crypto to stablecoins) can cap downside without waiting for a margin engine to decide.

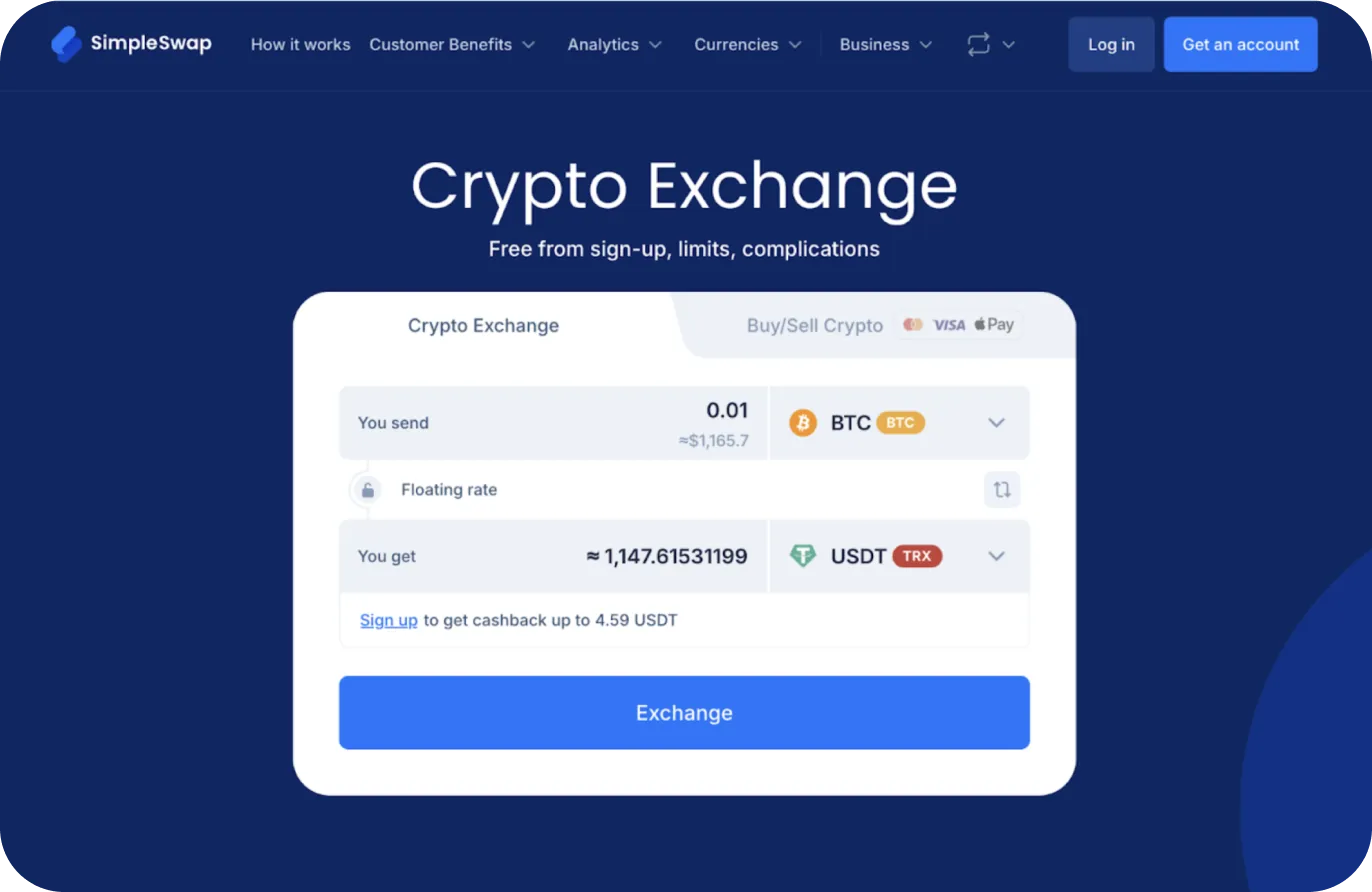

SimpleSwap offers a non-custodial, account-free swap flow: you pick a pair, provide a receive address, send the input asset, and receive the output. It’s a straightforward way to convert crypto to stablecoins when you need stability, with broad asset support and no ongoing custody.

Step-by-step: Swapping on SimpleSwap

- Choose the pair in the widget (e.g., BTC → USDT or ETH → USDC) and review the quoted rate and estimated arrival. Click Exchange.

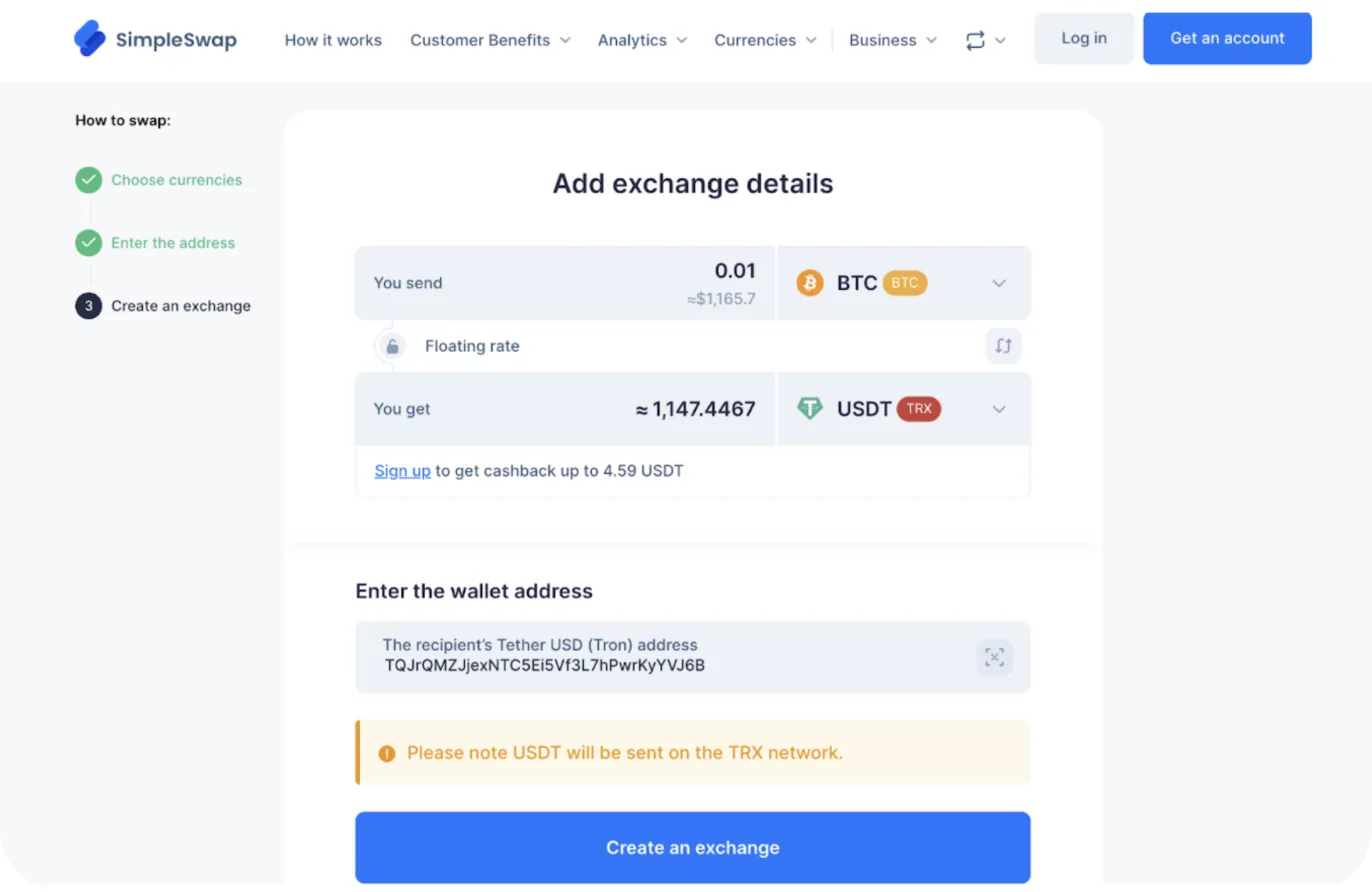

- Enter your receive address for the destination asset (double-check address format and network – e.g., TRON vs Ethereum USDT). Click Create an Exchange.

Confirm the swap to generate the deposit address for your input coin.

Send the exact amount from your wallet/exchange to the deposit address.

Wait for confirmations; once received, the output asset is sent to your receive address and the order shows “Finished.”

Save the order ID for support if needed. Tip: Always verify you’re on the intended chain and that your wallet supports the destination asset.

Actionable Tactics to Avoid Forced Liquidation

You can’t remove volatility, but you can reduce how much of it you must survive. The following habits turn chaos into checklists.

Position Sizing & Sensible Leverage

Set leverage limits that match your temperament and the asset’s historical swings. A practical rule of thumb: size so a typical daily move (plus a buffer) won’t drive your margin ratio near 100%. Many venues encourage keeping margin ratios comfortably below danger levels.

Isolated margin can ring-fence experiments so one trade can’t consume the whole account. If you’re new, favor low leverage and isolated mode until your process is battle-tested. Risk management is the lever you control every day.

Use Stop-losses/alerts Keyed to Mark Price

Set alerts based on the mark price and place stops with enough distance above your liquidation price to account for the delta between mark and last price.

Remember: last-price stops may not save you if the mark hits liquidation first. Most exchanges display the mark price on the contract page or order ticket – watch that number, not just the tape.

Add Margin or Reduce Size Early & Consider Hedging

If a position drifts toward the threshold, act early: add margin (extending runway), reduce size to lower maintenance requirements, or hedge with an offsetting position (e.g., an inverse perp or correlated asset hedge).

None of these guarantees success, but they widen your options and lower the chance of the engine taking over. If your broader thesis has flipped, consider voluntary liquidation to stable value and come back with a clearer plan.

Understand Platform Backstops

Know your venue’s order of operations in stress: partial liquidation attempts, insurance fund usage, and finally ADL that can de-risk the system by reducing opposing winners.

These backstops exist to protect market integrity – they are not a personal safety net. Review your platform’s explainer and monitor any ADL indicators if provided.

Calculating & Monitoring Your Liquidation Price

Good monitoring beats heroic reactions. Build a routine you can follow even on high-vol days.

What Inputs Matter

Your liquidation price calculator depends on a handful of inputs: entry price, position size, leverage, available balance, fee/interest model, and margin mode (cross vs isolated). Critically, the trigger uses the mark price, not the last price.

Check your venue’s help center for the exact formula and how portfolio or unified margin modes modify thresholds. The more leverage you use, the tighter that window becomes – so keep a close eye on the number and plan your adjustments in advance.

Practical monitoring checklist

Track the spread between mark price and your liq price, define “yellow” and “red” zones.

Set price alerts (SMS/app) at both zones; don’t rely on watching a screen.

Pre-decide add-margin and cut-size thresholds – no huddling under stress.

Review funding/fees if they move your maintenance needs.

Re-check your margin mode and free collateral before high-volatility events.

Keep a voluntary liquidation path handy: stablecoin address ready, SimpleSwap bookmarked.

Common Misconceptions

A few persistent myths cause expensive mistakes. Let’s clear them up quickly.

“Stops Always Trigger Before Liquidation”

Not necessarily. Because most venues liquidate on mark price while many stops trigger on last price, it’s possible for mark to hit your liquidation level before your stop executes. If your stop sits too close to the liquidation level, a small mark/last divergence can bypass it. Solution: watch mark price and build stop buffers.

“Only Longs Get Liquidated”

Shorts get liquidated too – just in the opposite direction. If price rises toward your short’s liquidation price (again, measured by mark), the engine can close your short at or near the bankruptcy price. The rules apply both ways.

“ADL/Insurance Fund Will Save Me”

Backstops – insurance funds and ADL – exist to protect platform solvency and orderly markets. They are not designed to optimize individual trade outcomes. Treat them as last-line system defenses, not as a personal fallback plan.

What to Do If You’re Near Liquidation

When minutes matter, a calm checklist beats improvisation. Breathe, then work the list.

Decision Tree (Now vs Soon)

Right now (imminent):

Cut size to lift your margin ratio immediately.

Add collateral if available to buy time.

Hedge with a small opposite-direction perp to neutralize delta short-term.

Soon (hours–days):

Re-evaluate the thesis; if broken, voluntarily liquidate part/all of the position to stablecoins.

Use a non-custodial swap (e.g., SimpleSwap) to off-ramp risk while retaining custody.

Update alerts and reduce leverage on remaining exposure.

FAQs

What Triggers Forced Liquidation?

Typically when the mark price reaches your liquidation price and your equity falls below maintenance margin; the engine closes positions to prevent negative equity.

What Is Partial Liquidation?

The platform reduces your position size in stages to bring your margin ratio back above maintenance, rather than closing everything at once.

What Is an Insurance Fund?

A pool the exchange uses to absorb residual losses when liquidations can’t complete at or above bankruptcy price, helping avoid socialized losses.

What is ADL (Auto-Deleveraging)?

A mechanism that, if the insurance fund is insufficient, reduces opposing profitable positions by priority to keep the system solvent.

What’s the Difference Between Mark, Index, and Last Price?

Index blends spot prices across venues; mark uses index plus smoothing to set fair reference and liquidation triggers; last is the most recent trade on your venue.

Cross vs Isolated Margin – What’s Safer?

Isolated caps loss to the margin on that specific position; cross shares collateral across positions, which is efficient but can spread risk.

Can I Exit Voluntarily Without Opening an Account?

Yes – SimpleSwap offers non-custodial, registration-free swaps; you supply a receive address and send from your wallet.

Glossary

Mark price

A manipulation-resistant reference used to calculate unrealized PnL and liquidation triggers, built from an index of spot exchanges plus smoothing.

Last price

The most recent traded price on a specific venue; useful for execution but not typically used for liquidation triggers.

Maintenance margin

The minimum equity required to keep a position open; falling below it initiates liquidation.

Insurance fund

Exchange pool that absorbs losses when liquidations can’t complete cleanly, reducing the need for socialized losses.

ADL (Auto-Deleveraging)

A backstop that reduces opposing winners to cover losses when insurance funds are insufficient, protecting system solvency first.