Weekly Crypto Market Wrap June 16-22, 2025

Last week felt like a powder keg. Tensions flared in the Middle East after the U.S. launched airstrikes on Iranian nuclear facilities, while Iran’s parliament seriously considered blocking the Strait of Hormuz — a crucial artery for global oil flows. If that happens, oil could spike past $120, and U.S. inflation could break 5%.

Markets got spooked. Bitcoin briefly dropped below $100K for the first time this month — only to get aggressively bought back. Altcoins weren’t as lucky, many got slammed, and liquidations surged into the billions. Now, let’s run through the rest of this week’s key stories.

Texas Approves State-Level BTC Reserve. The governor signed Bill SB21, allowing the state to create Bitcoin reserves. Texas is essentially building its own mini-Fed — but in BTC. This sets a huge precedent for other U.S. states. Bitcoin as a strategic reserve: now it’s not just for MicroStrategy.

BlackRock Now Holds 683,017 BTC — Over 3% of Total Supply. New data from the iShares Bitcoin Trust shows that BlackRock now holds $71.6B worth of BTC. This isn’t just portfolio diversification — it's a strategic position for future asset tokenization. BlackRock is quietly becoming one of Bitcoin’s biggest whales.

SEC Approves BTC Treasury Structure for Trump Media. The SEC approved Trump Media’s plan to include Bitcoin reserves in its public holding structure. Crypto continues its march deeper into U.S. politics.

Strategy Buys Another 10,100 BTC for $1.05B. Strategy continues to build its shadow central bank of Bitcoin. Their BTC balance now stands at 592,100 — more than the gold reserves of most countries.

Trump Org Cuts WLFI Stake from 60% to 40%. The Trump Organization reduced its stake in the DeFi venture WLFI from 60% to 40%. Likely an election-season move to de-risk exposure.

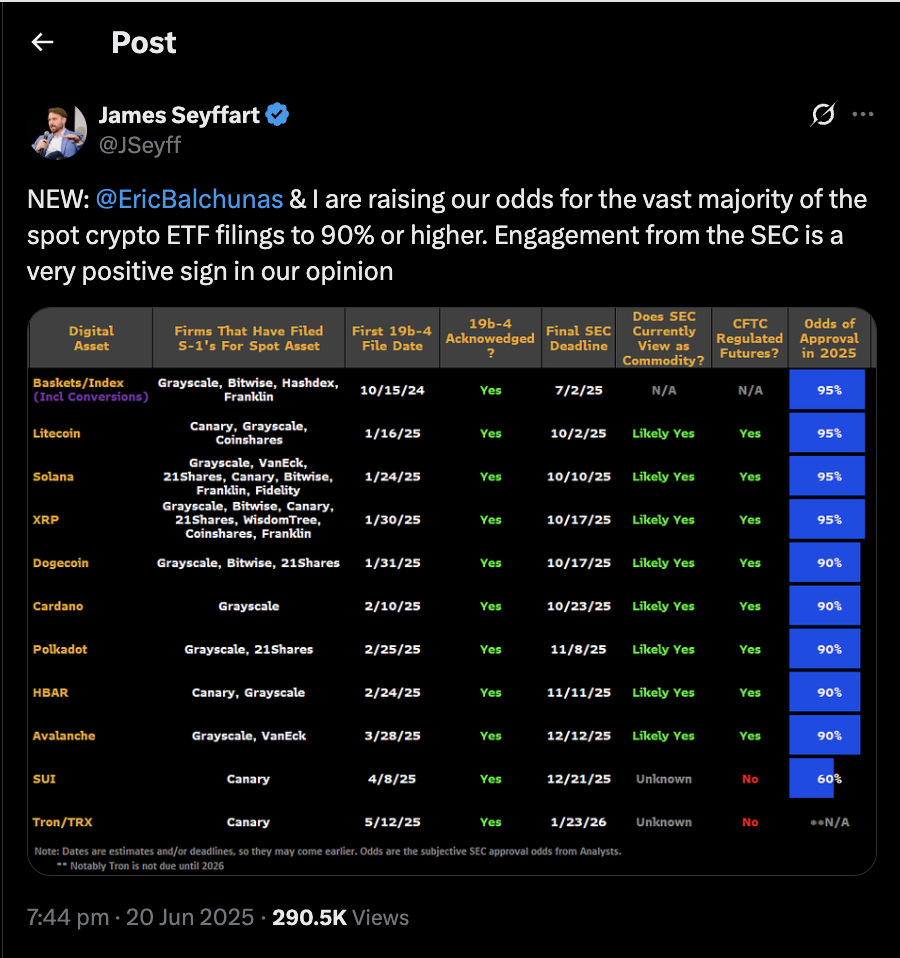

Bloomberg: 95% Odds of Altcoin ETF Approval. Bloomberg’s James Seyffart says ETF approval for Ethereum, Solana, and other majors is “basically inevitable.” The altcoin market may soon open its gates to billions in institutional capital.

Source: https://x.com/JSeyff/status/1936117896347803748

Coinbase Secures MiCA License in EU. Coinbase is now fully licensed under MiCA, the EU’s new crypto regulatory framework. This gives them pan-European access — a major milestone for compliance-led expansion.

Bybit Launching DEX on Solana by Month-End. Bybit is entering the DeFi arena with Byreal, a Solana-based DEX. It’s a direct play on speed and low fees, and a signal that centralized players are doubling down on decentralized rails.

Source: https://x.com/benbybit/status/1934105274975158614

Jupiter Suspends DAO Voting Through Year-End. The founder of Jupiter Exchange announced a pause on DAO governance until 2026. The goal: streamline mechanics and restore order — though some say this contradicts the ethos of decentralization.

U.S. National Debt Tops $37 Trillion. So much for fiscal responsibility. According to US Debt Clock, national debt continues to spiral — adding fuel to the Bitcoin-as-hedge narrative.

UK & U.S. Sign Trade Deal. Yes, even in 2025 — post-Brexit and all — the UK and U.S. have come together to sign a new trade agreement. Could bring fresh collaboration on digital assets and fintech.

Source: https://x.com/WatcherGuru/status/1934720890899505213

U.S. Senate Passes Stablecoin Regulation (GENIUS Act). The Senate has passed the GENIUS Act, now heading to the House. The law sets clear rules for issuance, reserves, and reporting — a big win for trust and compliance in the stablecoin sector.

SEC & Ripple Request Pause in Appeal Proceedings. Both sides are asking for more time in their ongoing legal battle. The longer the truce lasts, the better for market sentiment.

Secret Service Seizes $225M in Crypto. The largest crypto seizure in U.S. history — tied to fraudulent investment schemes and scams. Security in DeFi still has a long way to go.

Upcoming major token unlocks:

BLAST: $22.76M (35.2%)

ACX: $14.11M (22.8%)

VENOM: $9.84M (2.9%)

SOON: $8.43M (22.4%)

ALT: $6.52M (6.9%)

UDS: $3.56M (3.3%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.