Weekly Crypto Market Wrap July 21-27, 2025

The market held up after a massive $9B Bitcoin sell-off. You’d think 80,000 BTC hitting the market would be a death sentence — but Bitcoin bounced back to $119K, and ETH remains steady, trading in the $3,800–$3,900 range. Next up: the Fed meeting on July 30 and Trump’s new tariffs on August 1. Expect fresh volatility. Now, let’s break down the key stories of the week:

Galaxy Digital sells 80,000 BTC ($9B). One of the largest Bitcoin transactions ever. These coins had been dormant since the Satoshi era — but even that supply shock didn’t rattle the market. Crypto is maturing.

Trump Media buys $2B in Bitcoin. Yes, Trump fights for the dollar — but his media company is stacking sats. Hedge? Or do they know something we don’t?

JPMorgan to launch BTC and ETH collateralized lending (2026). A big one: Bitcoin and Ethereum will finally be treated as full-fledged collateral by Wall Street’s old guard. Real crypto legitimacy doesn’t come from laws — it comes from capital.

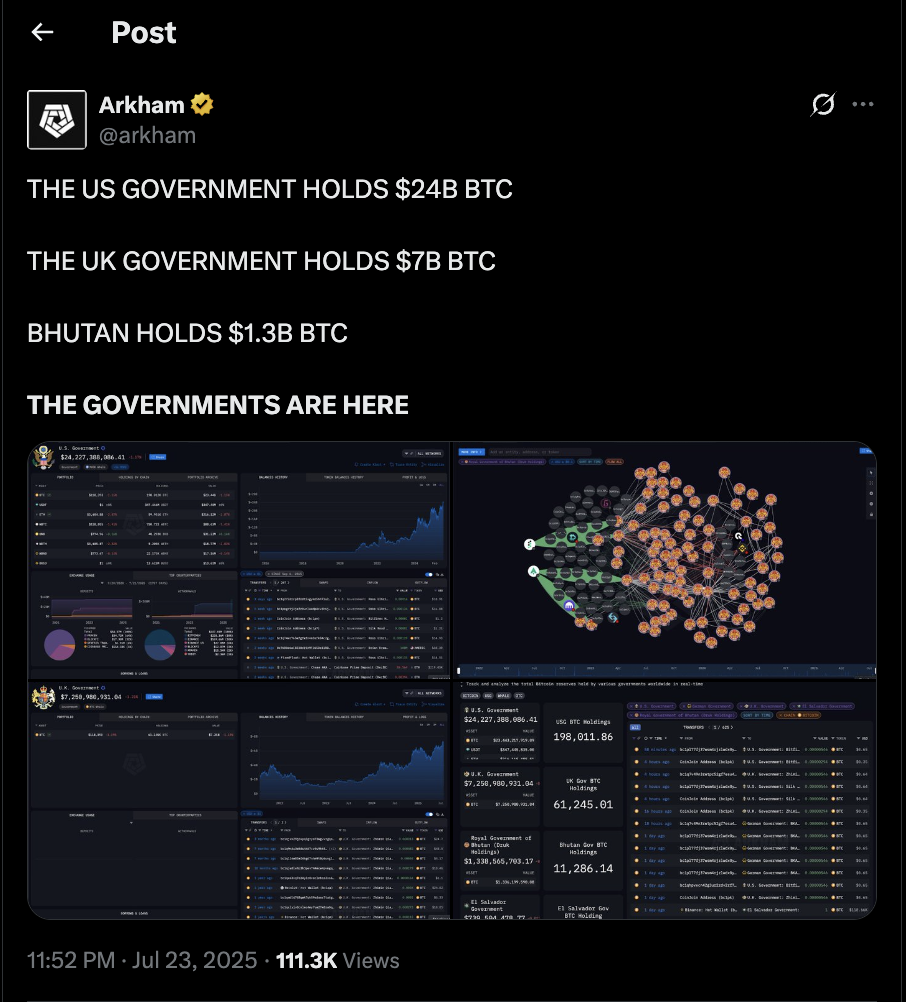

U.S. government still holds 198,011 BTC. Arkham confirms that the U.S. Treasury’s stash is real and massive. Waiting for $1M per coin?

Source: https://x.com/arkham/status/1948139085190537381

FTX repayment round 3 begins September 30. Lost funds on FTX? Another payout phase is just around the corner.

Strategy buys 6,220 BTC ($739M), now seeking $2.8B raise. Michael Saylor doesn’t slow down. The raise target jumped from $500M to $2.8B. Time to print more “Bitcoin is hope” shirts.

Source: https://x.com/saylor/status/1947266086627360854

BitMine doubles down on ETH — now $2B in holdings. The company is building an “Ethereum-as-a-treasury” strategy. Positioning for the Flippening?

Kingsway Capital plans a $400M TON reserve. TON is no longer just “Telegram’s token.” Funds are starting to treat it like a treasury asset alongside BTC and ETH.

Trump strikes trade deal with Japan — 15% tariffs incoming. Protectionism 2.0. These tariffs could hit not only equities but also crypto markets.

ECB holds rates at 2.15%. No change from Europe. They may not want to rock the boat, but global markets can still sink it.

Trump to lift all restrictions on AI development. The U.S. is ready to unleash AI. Ready for a future where a GPT runs for Senate? We’re closer than ever.

FBI clears Kraken founder Jesse Powell. Investigation closed. No charges. Kraken is clean — and the rumors can finally stop.

U.S. Court of Appeals rules NFTs are “commodities”. That ape in your wallet isn’t “just a JPEG” anymore — it’s a legally recognized asset. There’s no going back.

Upcoming major token unlocks:

SUI: $185.22M (1.3%)

JUP: $32.13M (1.8%)

ENA: $27.43M (0.6%)

OP: $25.77M (1.8%)

KMNO: $13.95M (9.4%)

SIGN: $12.47M (12.5%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.