Weekly Crypto Market Wrap July 14-20, 2025

Another strong week for the crypto market. Total crypto market cap briefly crossed $4 trillion, a solid rebound considering recent geopolitical tensions. Bitcoin closed confidently above $118K, and Ethereum hit nearly $3,800. Those who bought ETH early this year are finally in profit — and those who doubled down during the bear market are now up nearly 2x. A solid result for a fundamentally strong asset. Traditional markets also joined the party: the S&P 500 touched 6,300 for the first time ever, powered by Nvidia, AI, and broad investor euphoria.

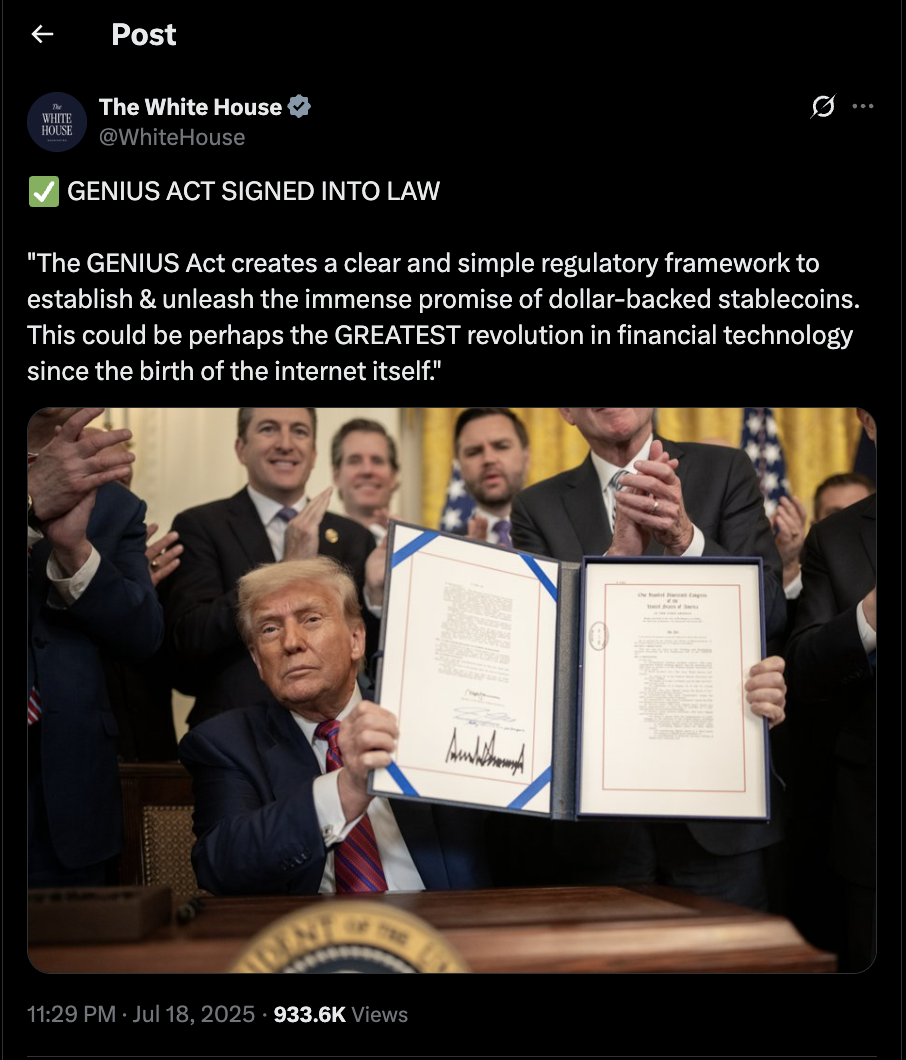

U.S. passes major crypto laws. The House passed three landmark crypto bills: GENIUS, CLARITY, and Anti-CBDC. GENIUS is already signed by Trump, marking the first official crypto signature in White House history. The message is clear: crypto is not the enemy — CBDCs are.

Source: https://x.com/WhiteHouse/status/1946336515186925710

U.S. Marshals Service now holds “just” 28,988 BTC. Down from nearly 70K in 2021. Looks like the sale of confiscated Bitcoin is in full swing.

TradFi continues onboarding to crypto. Standard Chartered has launched BTC and ETH trading for clients. Charles Schwab is also preparing to enter. Traditional finance is inching deeper into Web3.

SharpLink now holds more ETH than the Ethereum Foundation. With 280,600 ETH in its treasury (and plans to buy $5B more), SharpLink has overtaken the Foundation. Meanwhile, Bitmine has accumulated $1B in ETH. Looks like DeFi companies are doing what institutions were expected to do all along.

Strategy and Metaplanet continue stacking BTC. Strategy bought 4,225 BTC ($472.5M). Metaplanet added a modest 797 BTC ($93.6M), bringing its total holdings to 16,352 BTC. Corporate Bitcoinization is alive and well.

Nvidia resumes H20 chip sales in China. After export restrictions halted supply, H20 chips are back on the Chinese market. A potential tailwind for regional AI infrastructure growth.

U.S. inflation exceeds expectations — 2.7% vs. 2.6% forecast. Not a huge miss, but enough to put pressure on the Fed. For now, rate cuts are off the table.

BofA: U.S. stock market might be a bubble. Bank of America warns investors are ignoring risks — especially Trump's aggressive policy moves. Capital flows into U.S. equities are falling, and the bubble may be inflating faster than many think.

Grayscale files for U.S. IPO. The crypto asset manager has officially filed for a public listing — a potential milestone for institutional legitimacy in the industry.

Source: https://x.com/DeItaone/status/1944744172998549885

U.S. regulators issue guidance on crypto custody for banks. The new framework permits crypto custody, but with strict risk controls and compliance standards. Another step toward normalizing crypto within the traditional banking sector.

Hungary cracks down: fines for unlicensed crypto use. Operating on unregulated platforms can now result in real penalties. Not every region is embracing the wild west of Web3.

Citigroup is developing its own stablecoin. Details are scarce, but the trend is clear: every major bank wants its own digital dollar.

Upcoming major token unlocks:

AVAIL: $19.74M (38.7%)

VENOM: $12.72M (2.9%)

ALT: $9.11M (6.5%)

SAHARA: $7.26M (4.2%)

SOON: $6.17M (22.3%)

UDS: $4.36M (3.9%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.