Weekly Crypto Market Wrap August 4-10, 2025

ETH is up 21% this week, putting Vitalik back in the billionaire club. BTC is once again trading above $120K and aiming for new highs. Market sentiment is so bullish that even Arthur Hayes — who was extremely skeptical — has flipped and is buying crypto. Key highlights of the week:

Trump and Bitcoin in 401(k)s. Donald Trump signed a law allowing BTC investments in retirement plans. To keep crypto from being squeezed out of the banking system, he also signed an order against debanking. American retirees, get ready — your pension could depend on Bitcoin holding the $100K level.

USDT — the main fee sponsor. A study shows that 40% of all transaction fees on top chains (ETH, Tron, TON, etc.) come from sending USDT. Turns out Tether isn’t just about stability — it’s also a constant tip jar for miners and validators.

Source: https://x.com/paoloardoino/status/1952700324931637709

$5B bet on Ethereum. Fundamental Global plans to raise $5B through a stock offering to buy ETH. Looks like someone believes Ethereum’s honeymoon phase isn’t over yet.

Massive Bitcoin buys. Strategy purchased 21,021 BTC ($2.4B), and Metaplanet added another 463 BTC ($53.7M). The whales are back — and this time, it’s no joke.

The British guy with 8,000 BTC has a new twist. James Howells — the man who accidentally threw away a hard drive in 2013 containing $950M worth of BTC — is refusing to dig through the landfill but isn’t giving up on the coins. Now, he plans to tokenize his lost BTC into Ceiniog Coin (1 token = 1 satoshi). ICO launches at the end of 2025. Apparently, it’s easier to start a DeFi project than fight city hall.

Trump’s crypto adviser steps down. Bo Hines resigned, possibly unable to keep up with the president’s constant Bitcoin tweets and ongoing trade wars.

Source: https://x.com/EleanorTerrett/status/1954271162604859791

Coinbase and PayPal play banker. They’re now offering 3–4% APY on stablecoins, neatly sidestepping the GENIUS Act. Think of it as a bank deposit — but without the bank… or the insurance.

U.S. hikes rates (and tariffs). Trump slapped +25% tariffs on India and +100% on microchips. Trade Wars 2.0 are officially on air.

EU decides not to fight the U.S. The bloc has paused trade countermeasures for six months, apparently waiting to see how this “tariff tennis” ends.

Source: https://x.com/DeItaone/status/1952360754893713620

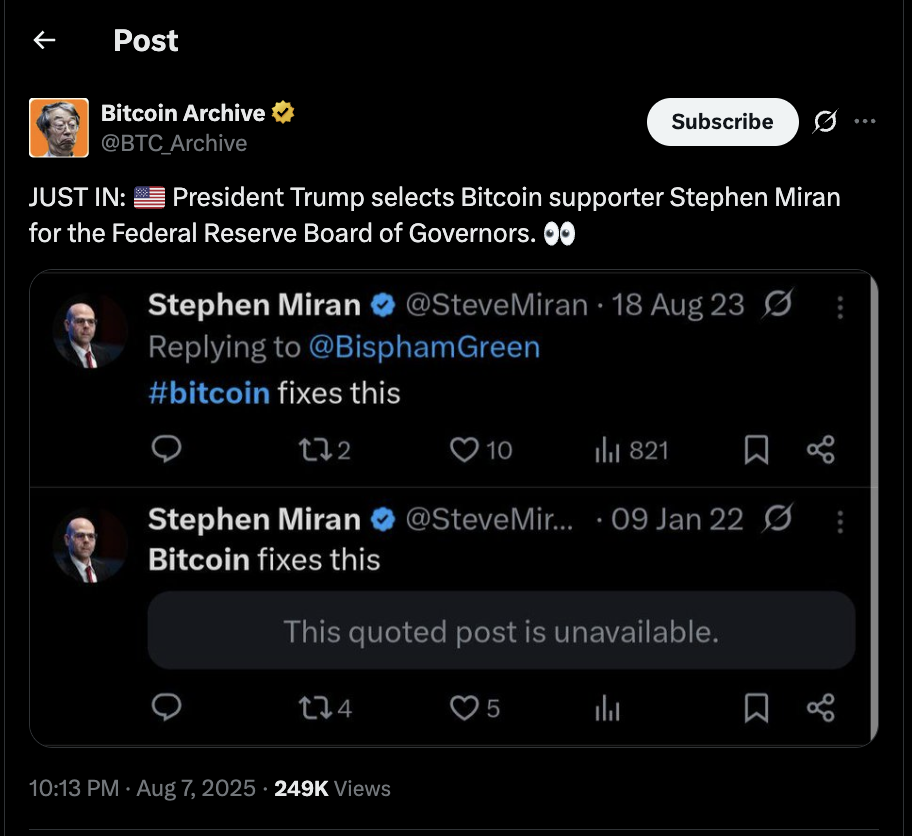

Trump places his people. Stephen Miran will take a vacant seat on the Fed board — a classic “friends in the right places” move.

Source: https://x.com/BTC_Archive/status/1953550035846648098

Ripple vs SEC — game over. The case is finally closed. SEC can go on vacation, and XRP holders can pop the champagne.

China cools stablecoin hype. Regulators have told brokers to stop promoting stablecoins, apparently fearing the “stable” will become too popular.

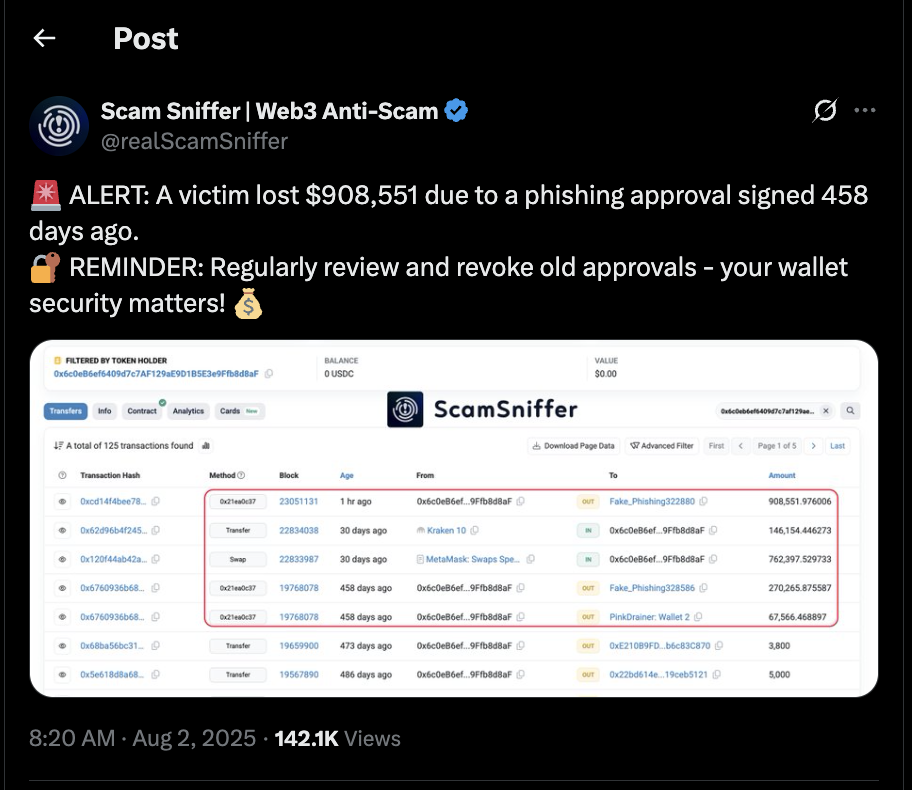

Delayed-trigger phishing. A crypto holder lost $908K due to a phishing transaction signed over a year ago. Moral of the story: always check what you’re clicking — even if “it was a long time ago.”

Source: https://x.com/realScamSniffer/status/1951528627985850508

Upcoming major token unlocks:

FTN: $91.80M (4.6%)

CHEEL: $88.25M

CONX: $55.32M (201.9%)

APT: $52.25M (1.7%)

ARB: $41.25M (1.7%)

AVAX: $38.87M (0.4%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.