Weekly Crypto Market Wrap August 25-31, 2025

Bitcoin just closed its third straight red week, down 4% over the past seven days – but the real hype wasn’t about BTC, it was Trump. He vanished so mysteriously that X (Twitter) was literally trying to track him down. Even now, not everyone is convinced he’s fine, despite golf course photos surfacing. Trump himself dismissed the rumors of his death with a post saying he’s “never felt better in his life.” Now, let’s move to the week’s main stories:

Arthur Hayes says stablecoins will become the U.S. Treasury’s weapon. If dollar tokens start getting handed out left and right, it could seriously fuel the bull run. The irony? They’re printing money even on the blockchain.

BitMine is now the world’s biggest ETH whale. Its stash has hit 1.7M ETH ($8.8B), with $2.2B added just this week. Looks less like they’re prepping for crypto winter — and more like they’re gearing up for altseason.

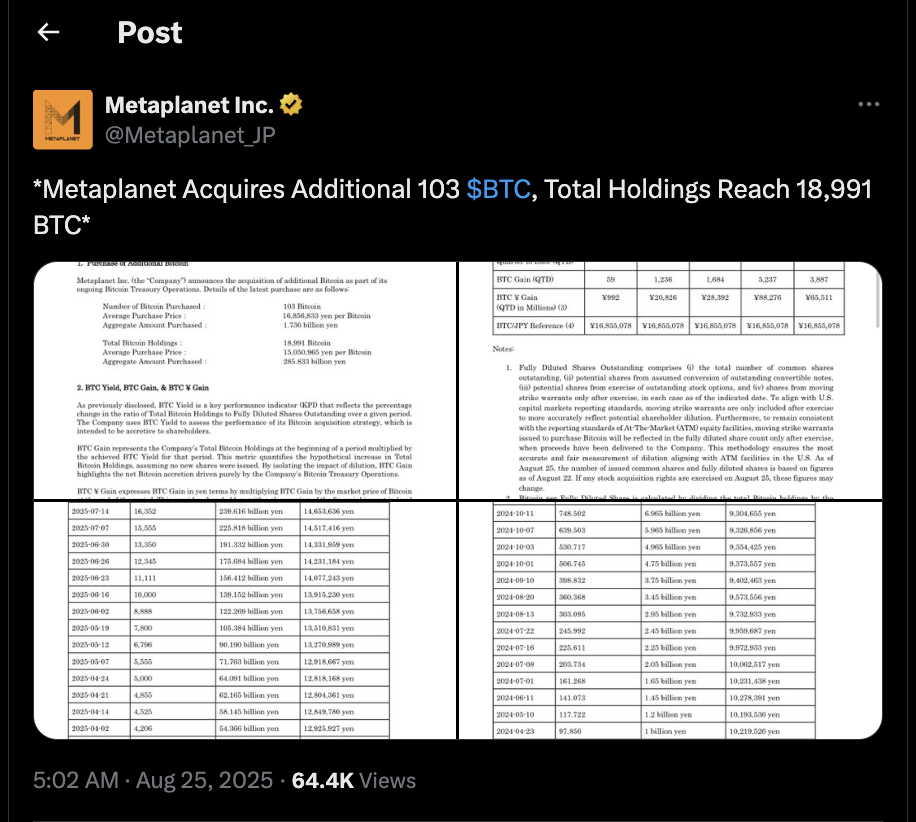

Strategy scooped up 3,081 BTC ($356M), while Japan’s Metaplanet added another 103 BTC. Institutions keep stacking sats while retail keeps whining that it’s “too expensive.”

Source: https://x.com/Metaplanet_JP/status/1959813527281250740

A whopping 92 crypto ETF applications have been filed in the U.S. Imagine the flood of ads: “Invest in Bitcoin – with retirement dividends.”

U.S. Department of Commerce to store economic data on blockchain. That’s right – even macro stats are going on-chain.

CFTC now lets Americans trade on foreign exchanges. The regulator literally opened the gates – “not your keys, not your jurisdiction.”

Gemini launches a Mastercard credit card with up to 10% cashback – in XRP. Yes, you can now buy coffee and get your change back in Ripple.

Robinhood lists TON. Pavel Durov is probably grinning somewhere, and the community is already whispering “to the moon.”

Source: https://x.com/NewListingsFeed/status/1961033305333055920

U.S. Q2 2025 GDP revised up to 3.3% from 3%. The economy’s basically saying: “No recession for you.”

Trump hikes tariffs on imports from India to 50%. Translation: Mango Lassi in New York is about to cost a lot more.

Nvidia posts a record $46.7B profit. Jensen Huang is literally printing money with chips – while cutting side deals with the White House on Blackwell AI exports to China.

Source: https://x.com/LizClaman/status/1961042704684523890

U.S. extends its tariff pause on China until the end of November. Yet another “final extension.”

U.S. appeals court rules Trump’s tariffs illegal, but enforcement is delayed until October. For now, we’re living in tariff-Schrodinger.

Meanwhile, Trump fired Fed board member Lisa Cook. Seems like too many dissenting voices at the table. Should Jerome Powell start watching his back?

Elon Musk sues Apple and OpenAI over AI monopoly and App Store “rigging.” Titan vs titan – let’s see whose lawyers are stronger.

Upcoming major token unlocks:

WLFI: $7.50B (94.1%)

ENA: $135.02M (3.2%)

IMX: $12.51M (1.3%)

ELX: $6.70M (20.9%)

IOTA: $4.48M (0.6%)

RED: $2.37M (2.0%)

SimpleSwap reminds you that this article is provided for informational purposes only and does not provide investment advice. All purchases and cryptocurrency investments are your own responsibility.