USDT vs USDC: Comprehensive Comparison of Leading Stablecoins

This blog post will cover:

- Understanding Stablecoins

- USDT and USDC: An Overview

- Transparency, Regulatory Compliance, and Reserve Backing

- Use Cases and Adoption

- Risks, Controversies, and Stability

- How to buy USDT (Tether)?

- Future Outlook

- Conclusion and Recommendations

Stablecoins have rapidly emerged as essential components within the cryptocurrency ecosystem, bridging traditional finance and digital assets by offering a stable store of value amidst market volatility. Among these, Tether (USDT) and USD Coin (USDC) stand out as the two most dominant and widely-used stablecoins, facilitating billions in daily transactions. Understanding the subtle but crucial differences between USDT and USDC can significantly impact traders, investors, and users alike, making a detailed exploration of their features, trustworthiness, and market presence imperative for anyone involved in the crypto space.

Understanding Stablecoins

Stablecoins are digital currencies pegged to a stable reserve asset, typically fiat currencies like the U.S. dollar, designed to minimize volatility common to cryptocurrencies like Bitcoin or Ethereum. By maintaining this peg, stablecoins provide a reliable medium of exchange, allowing crypto market participants to securely park funds, execute transactions, and mitigate exposure to unpredictable price swings. This price stability fosters confidence among users, enabling smoother transactions across exchanges and supporting decentralized finance (DeFi) platforms.

Beyond mere price stability, stablecoins streamline cross-border payments, reduce transaction times, and lower fees associated with traditional banking systems. They facilitate liquidity within the crypto market, acting as intermediaries that simplify trades between fiat currencies and cryptocurrencies. With their inherent stability, stablecoins like USDT and USDC have become foundational elements of digital finance, playing pivotal roles in diverse use-cases—from hedging market risks to remittance services, underscoring their integral position within the modern crypto economy.

USDT and USDC: An Overview

Tether (USDT), launched in 2014, was one of the first stablecoins introduced to the cryptocurrency market. Issued by Tether Limited, USDT is pegged 1:1 to the U.S. dollar, making it widely adopted due to its first-mover advantage. Despite controversies surrounding reserve transparency, USDT remains the largest stablecoin by market capitalization, serving as a critical liquidity provider across global crypto exchanges. Its ubiquity and acceptance have solidified USDT as a cornerstone asset in digital trading platforms worldwide.

USD Coin (USDC), developed jointly by Coinbase and Circle in 2018, rapidly gained market share through transparency and regulatory compliance. Backed fully by U.S. dollar reserves held in audited bank accounts, USDC enjoys substantial trust among institutional investors and retail users alike. As of today, it ranks closely behind USDT in market capitalization, offering strong competition due to its clear regulatory stance and growing adoption across decentralized finance applications. Both USDT and USDC have distinct strengths, shaping their respective roles in a continually evolving cryptocurrency landscape.

Transparency, Regulatory Compliance, and Reserve Backing

Transparency, regulatory compliance, and reserve backing are crucial considerations when evaluating stablecoins, directly influencing user trust and long-term viability. By examining these key areas, investors and crypto users can better understand the differences between USDT and USDC.

Transparency and Auditing

Transparency significantly differentiates USDC and USDT, particularly regarding their reserve disclosures and auditing practices. USDC has established itself as a leading stablecoin largely due to its clear and regular auditing. Circle, the company behind USDC, consistently provides monthly reserve reports certified by independent auditors. This practice ensures that investors and users can verify USDC’s assets match the circulating tokens, thus reinforcing trust and confidence in the stablecoin.

In contrast, Tether (USDT) has historically faced controversies over its transparency. Tether Limited has previously been criticized for irregular disclosure practices and inadequate third-party audits. Although recent improvements have included periodic reserve reports to boost credibility, skepticism among regulators and market participants persists. The absence of regular comprehensive audits comparable to USDC’s practices continues to spark debates around Tether’s reserve integrity and long-term stability.

Regulatory Compliance

Regulatory compliance significantly impacts the credibility and longevity of stablecoins, making adherence to financial regulations vital. USDC stands out by prioritizing regulatory compliance and transparency. Its issuer, Circle, operates under strict financial oversight, maintaining licenses from multiple regulatory bodies. By collaborating closely with U.S. regulators, USDC positions itself as a highly compliant and trusted stablecoin, appealing especially to institutions and regulated platforms.

USDT, meanwhile, has faced greater scrutiny regarding its regulatory stance. Tether Limited has encountered various legal and regulatory challenges, including investigations by the New York Attorney General (NYAG) into its reserve practices. Although Tether settled these disputes and has since enhanced its compliance frameworks, lingering uncertainty remains around its regulatory clarity. Nonetheless, USDT maintains a dominant global presence, especially in markets with lighter regulatory oversight, due to its flexibility and broad accessibility.

Reserve Backing and Stability

Both USDT and USDC claim a 1:1 peg to the U.S. dollar, but their reserve backing mechanisms differ substantially, influencing their perceived stability. USDC strictly backs each issued token with cash and short-term U.S. Treasury bonds. This conservative, transparent reserve approach minimizes risk and sustains user confidence in USDC’s stability, even during market turbulence.

Conversely, USDT’s reserve structure includes a broader range of assets beyond cash, such as commercial paper, secured loans, and other investments. While this diversified approach may offer higher returns to the issuer, it introduces potential risk exposure. Despite occasional concerns over its stability, USDT has successfully maintained its peg through multiple market disruptions, underscoring its resilience. Nevertheless, transparency and consistency in reserve assets remain critical considerations for users comparing these stablecoins.

Use Cases and Adoption

Both USDT and USDC have widespread adoption, though their specific use cases differ significantly. USDT’s early launch and global availability have cemented its role as the predominant stablecoin for cryptocurrency trading. With the highest trading volumes among stablecoins, USDT remains the primary intermediary asset for traders seeking quick and efficient movement of funds across exchanges. Its liquidity makes it indispensable in arbitrage strategies, margin trading, and short-term speculative activities.

USDC, while also popular in trading, has distinguished itself particularly within the decentralized finance (DeFi) ecosystem. Thanks to its regulatory transparency, USDC is preferred by DeFi protocols, lending platforms, and institutional investors seeking compliant and secure transactions. Additionally, USDC has gained notable traction in remittances and cross-border transfers, thanks to its clarity of backing and regulatory approval, making it particularly attractive to institutions operating under stricter compliance standards.

In terms of adoption, USDT currently holds the largest market capitalization among stablecoins, reflecting its vast acceptance and accessibility globally. However, USDC has rapidly closed the gap, significantly increasing its market presence through strategic partnerships, adoption by major platforms, and institutional backing. Recent figures indicate steady growth in USDC’s market share, particularly driven by users prioritizing regulatory compliance and stability, showcasing a clear upward trajectory in its broader crypto adoption.

Risks, Controversies, and Stability

USDT’s history contains several notable controversies, primarily revolving around transparency, reserve backing, and regulatory compliance. One significant event involved allegations from regulators, particularly the NYAG’s investigation in 2021, which questioned Tether’s reserve adequacy. Although Tether settled the investigation without admitting wrongdoing, it was required to improve transparency and regularly publish reserve reports. Additionally, periodic doubts about USDT’s ability to maintain its peg during extreme market volatility occasionally affect user confidence.

USDC, by comparison, has experienced fewer controversies, largely due to its rigorous auditing and transparent regulatory stance. Nevertheless, it faced a significant event during the March 2023 banking crisis when it temporarily lost its 1:1 peg due to its exposure to Silicon Valley Bank. The event, however, was swiftly resolved, with Circle promptly restoring confidence by securing alternative banking arrangements and transparently communicating the stability of its reserves, quickly returning the token to its pegged value.

Both stablecoins have actively implemented measures to mitigate future risks. Tether has increased its transparency efforts, periodically publishing attestation reports. Circle has further diversified its reserve banking partnerships and tightened risk management practices, reflecting an ongoing commitment to stability and trustworthiness. Yet, market participants must remain aware that no stablecoin is entirely risk-free, with trust and transparency being critical factors in their long-term adoption.

How to buy USDT (Tether)?

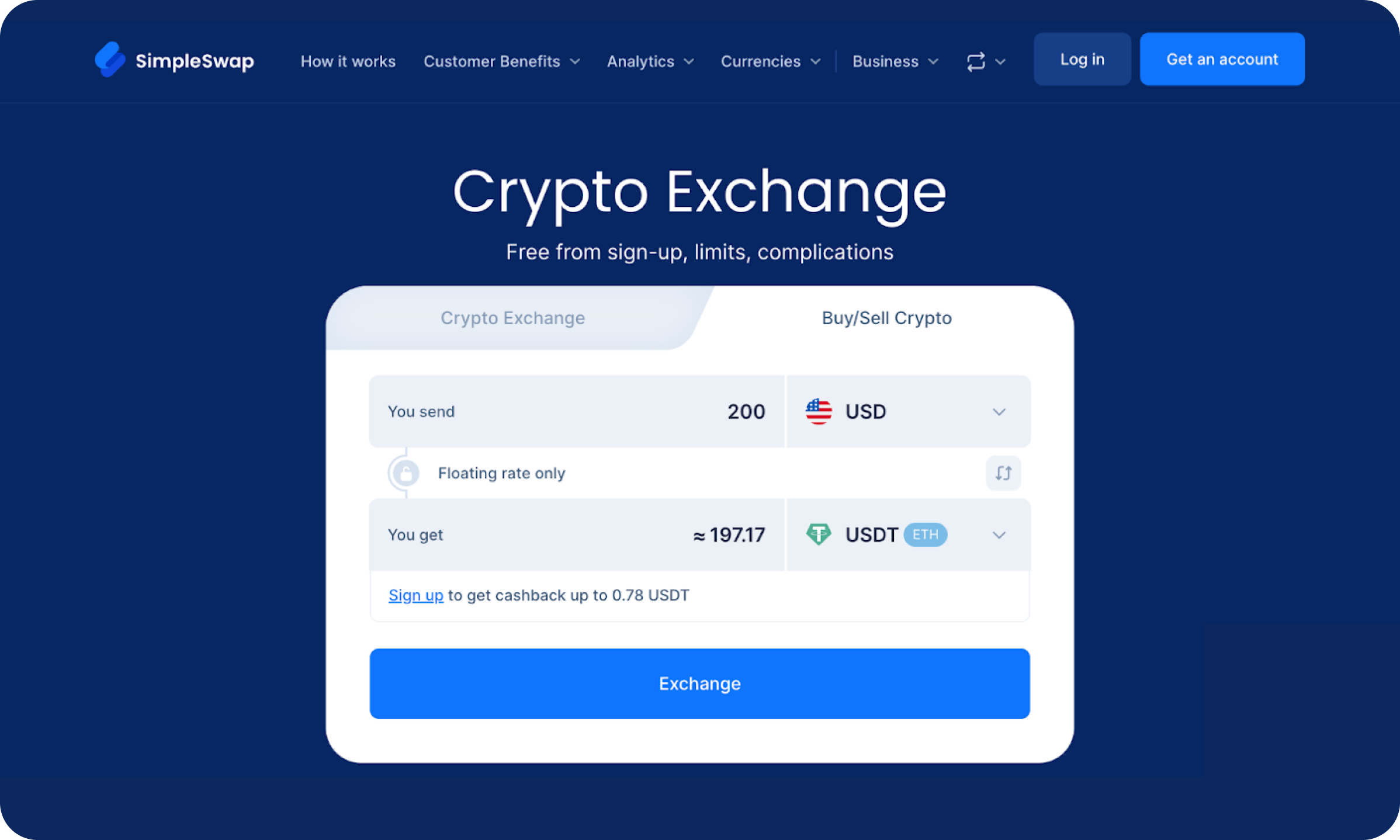

Buying USDT is simple and secure with SimpleSwap, a reliable platform that enables seamless crypto exchanges without complicated registration or lengthy verification procedures. With SimpleSwap, users enjoy:

Fast, easy transactions

No sign-up required

Competitive exchange rates

Support for a variety of cryptocurrencies

Follow these easy steps to buy USDT through SimpleSwap:

- Choose currencies: In the first drop-down, select the currency you want to exchange (e.g., USD) and enter the desired amount.

- Select USDT: In the second drop-down list, select USDT. You'll immediately see the estimated amount of USDT you'll receive.

- Start exchange: Click the "Exchange" button.

- Enter Recipient’s Address: Provide the correct wallet address where your USDT will be sent.

- Complete the exchange: Follow the prompts to finalize the transaction.

If you want to buy USDC instead, the steps remain exactly the same—just select USDC from the "You get" list.

Future Outlook

The future trajectory for both USDT and USDC is closely tied to evolving regulatory frameworks, crypto market dynamics, and user preferences. As regulators globally become increasingly vigilant about crypto oversight, USDC appears strategically positioned to capitalize on tighter compliance requirements. Its transparent approach and proactive engagement with regulators suggest continued growth, particularly among institutions and users in highly regulated jurisdictions.

USDT, while continuing to dominate global trading volumes, faces pressure to align more closely with transparency and regulatory standards. To maintain market leadership, Tether will likely need to enhance transparency further and reassure stakeholders of reserve adequacy and regulatory compliance. Both stablecoins will also need to adapt continuously to emerging trends like increased DeFi integration, CBDC competition, and enhanced cross-border payment infrastructures, influencing their roles in the broader crypto landscape.

Conclusion and Recommendations

In summary, USDT and USDC each serve distinct niches within the crypto ecosystem, reflecting differences in transparency, regulatory compliance, and risk management. Users prioritizing regulatory clarity, stable reserves, and transparent auditing practices might prefer USDC, especially institutional investors or compliance-sensitive entities. Conversely, traders prioritizing liquidity, broader market acceptance, and global accessibility might find USDT more advantageous. Understanding these nuances ensures informed choices, aligning stablecoin selection with personal or organizational risk tolerance and operational needs.