MECE Framework Explained: Mutually Exclusive vs Collectively Exhaustive Principle And Examples

This blog post will cover:

- Introduction

- Collectively Exhaustive vs Mutually Exclusive: The Core Principle

- Why MECE Matters

- How to Apply MECE Step-by-Step

- MECE Examples and Templates

- Common Mistakes and Fixes

- Do I Always Need to Be 100% MECE?

- Advanced Patterns

- Toolkit: Checklists and Worksheets

- Round-Up

- FAQ

Introduction

Clear thinking is a superpower in crypto decisions – from sizing markets to choosing which coins deserve a deeper look. The MECE framework gives you that clarity.

The MECE acronym (pronounced “mee-see”) stands for mutually exclusive and collectively exhaustive. It is widely taught in problem-solving and presentation writing, with roots popularized by Barbara Minto and her Pyramid Principle at McKinsey.

The idea is simple: split a complex whole into non-overlapping buckets that together cover the entire space. That structure turns a messy debate into a map. You will see how to do it in minutes, instead of months. The MECE principle is broadly used by the top consulting firms and otherwise.

In this article we will define MECE, compare the two parts of the principle, show why it matters for crypto analysis, and walk through a practical five-step method of how to use the MECE principle. Then we will work through general and crypto-specific examples of MECE structure, highlight common pitfalls, and wrap with advanced patterns, checklists, and an FAQ.

This educational content is for information only and does not constitute financial advice in any form.

What Is MECE Principle in One Minute

So, what does MECE mean in plain terms? The MECE framework implies a way to structure and categorize information into buckets that do not overlap and yet cover the full set.

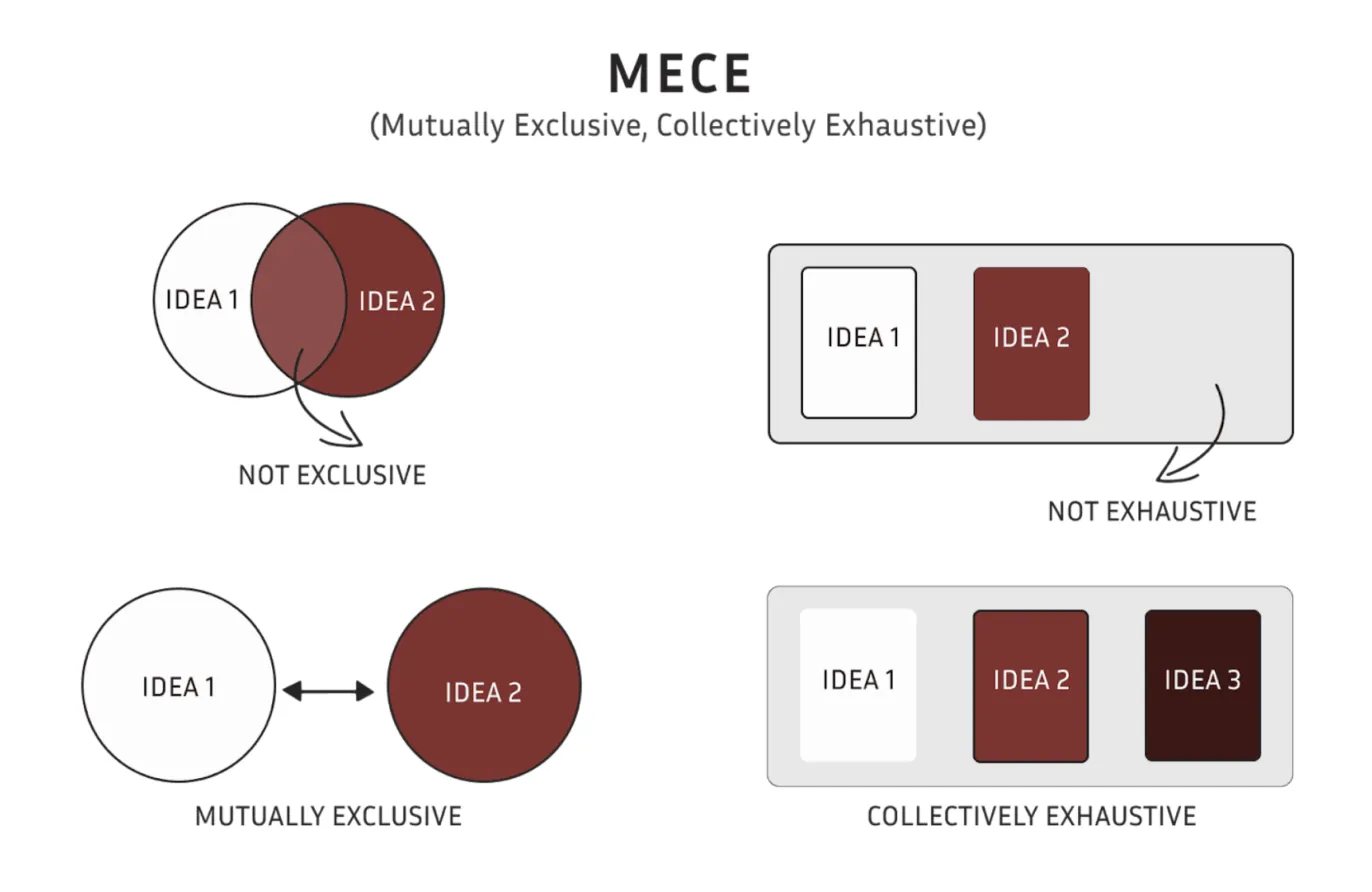

Mutually exclusive means one item can live in one bucket only.

Collectively exhaustive means every relevant item lands somewhere, so no gaps.

Picture an exchange analyst mapping wallet inflows by source: retail, institutions, miners, and “unknown tagged.” If the definitions are crisp, each deposit belongs to one group, and together these groups explain 100 percent of inflows. That is the very MECE meaning in action.

The payoff is practical. A MECE map lets you measure cleanly, spot double counting, and debate facts rather than wording, which might be the case in a non-MECE framework. In this guide you will get a short method, tests for overlap and gaps, quick examples, and suggested ready-to-use tools: an audit checklist, a bucket definition template, and a light governance rule for “Other.”

Think of it as a thinking scaffold you can reuse across crypto questions, from token research to growth planning.

Collectively Exhaustive vs Mutually Exclusive: The Core Principle

The two halves of MECE often get mixed up. Treat mutually exclusive and collectively exhaustive them as separate tests you run back to back.

Collectively Exhaustive (CE)

Collectively exhaustive meaning the buckets covering the whole without leaving relevant items outside. If you group “crypto traders” by experience – beginner, intermediate, advanced – the set should include every trader you care about for that analysis.

A quick test is the coverage scan: imagine data flowing in and ask, “Where would this new item go?” If you cannot place it, you found a gap.

Mini example: Revenue by product line that sums to 100 percent, no revenue left unassigned.

Use “Other” as a safety net but make it time-bound and reviewed, since it can hide patterns if it grows unchecked.

Coverage scan tips: look for edge cases like multi-chain users or cross-listed tokens. If they appear often, add a real bucket, or redefine scope to keep CE honest.

Mutually Exclusive (ME)

Mutually exclusive principle means there's no overlap. An item fits only one bucket. If you segment crypto holders by primary intent – trade, invest, use DeFi – a single wallet should not be counted in two groups in the same cut.

The overlap test is blunt and useful: “Could the same item meet two bucket definitions at once?” If yes, tighten the wording or choose a different axis.

Mini example: Market share by chain where each transaction is attributed to exactly one chain using a clear rule.

Add a yes or no overlap check for your team: if two reviewers could reasonably place an item in different buckets, definitions need work.

A crisp demonstration often comes from market analysis, like splitting stablecoin supply by collateral type (fiat-backed vs crypto-backed vs algorithmic) with explicit criteria for mixed designs.

Source: StrategyU

Why MECE Matters

The MECE principle reduces ambiguity. Reviews move faster when everyone sees the same map. In crypto, clean segmentation unlocks auditability – you can trace a metric to its bucket rules and re-create it next quarter.

That matters for recurring dashboards, investor updates, and risk committees. Clear buckets also make decisions repeatable. If a listing team scores coins by MECE criteria, you can explain why a token advanced or stalled using the same yardstick each cycle.

MECE also sets up clean metrics and avoids double counting. Think about typical crypto metrics: trading volume by venue, liquidity by pair, spread by tier, active wallets by cohort, KYC completion by funnel step, acquisition cost by channel, and PnL by strategy.

With mutually exclusive/collectively exhaustive structure, each event or user sits in one place, so totals add up without surprises. That cleanliness supports prioritization. After structuring, apply 80/20 thinking – focus on the buckets that drive the bulk of volume or churn. MECE supplies the map and Pareto points to the hotspots.

How to Apply MECE Step-by-Step

Let’s connect the MECE principle to practice. The steps below turn a vague question into a usable structure.

Step 1: Define the Question and Unit of Analysis

Start with a single, sharp question and name the unit you will classify. Ambiguity here spreads everywhere. Write one sentence that states the goal and one line that states the unit.

Problem statement: “Which growth levers will lift verified monthly traders in Q4?”

Unit of analysis: “Individual user accounts that completed KYC.”

Scope constraints: time window, geographies, chains, or products included.

Anchor every later choice to this framing. If someone proposes a bucket that classifies wallets instead of users, you can flag the mismatch instantly.

Step 2: Propose First-Level Buckets

Choose one logical axis for the first split. Resist mixing dimensions. For crypto decisions, three starter axes tend to work:

Stages: acquire, activate, retain, monetize for growth questions.

Segments: user type, geography, chain, device for behavior questions.

Drivers: price, liquidity, utility, community for token research.

Write 3–6 buckets on one axis only. If you feel tempted to add a different lens, save it for a second level.

Step 3: ME Check (No Overlaps)

Run overlap tests. Take a handful of real items and try to place them. If any item fits two buckets, rewrite definitions or draw numeric boundaries.

Checklist: “Can a single item fit two buckets?” If yes, fix wording or pick one axis.

Use thresholds: for example, “primary chain” equals the chain with 60 percent or more of a user’s on-chain value.

Add a priority rule: if an item qualifies for two buckets, send it to the higher-priority one by design, not accident.

These small edges make ME a yes or no check rather than a debate.

Step 4: CE Check (No Gaps)

Stress-test completeness. Try to break your model with counterexamples and rare cases. Ask teammates to toss oddballs at the structure.

Edge-case sweep: cross-chain users, multi-token pools, OTC deals.

Sum test: do the buckets add up to 100 percent or the full count of units.

Responsible “Other”: allowed as a short-term parking lot with a clear review date and size cap.

If “Other” keeps growing, it points to a missing recurring pattern. Promote it to a real bucket.

Step 5: Iterate and Validate with Data

Pilot the structure on a small sample. Measure how many items needed manual judgment and how often reviewers disagreed. Adjust definitions until placement is boring.

Keep a bucket dictionary: name, definition, rules, and examples.

Track a simple acceptance bar: for example, fewer than 2 percent of items need arbitration on a random sample of 200.

Version control the structure: record change dates so trends remain comparable.

Consistency is the quiet win here.

Table: Quick mutually exclusive vs collectively exhaustive tests

Test | Goal | How to Run | Pass Signal | Fail Signal |

Overlap test | No double placement | Try to place one item into two buckets | You cannot do it without bending rules | A normal item fits two buckets |

Coverage test | No gaps | Throw counterexamples and edge cases at the set | All important items have a home | You name a relevant item with no home |

MECE Examples and Templates

Examples make the idea stick. We will start broad, then shift to crypto-specific cases.

General Business Examples (Quick Wins)

Cost drivers: fixed vs variable. Before: a mixed list like “rent, salaries, cloud, marketing, contractors.” After: fixed costs that do not change with volume and variable costs that scale with activity. De-duplication stops salaries from appearing under two labels.

Growth levers: acquire, activate, retain, monetize. Before: “email, push, landing pages, fees.” After: each lever maps to one stage, and activities sit under the right lever. No overlap, full coverage.

Support workload: prevent, deflect, resolve. Before: “FAQs, bots, backlog, refunds.” After: prevention covers product fixes and education, deflection covers self-serve and forums, resolve covers agent tickets. Totals sum cleanly, so staffing plans make sense.

Crypto-Specific Examples

Trading revenue decomposition

Price-driven vs volume-driven vs product-driven. Define fees as a function of maker-taker pricing, traded notional, and product mix. An order contributes to one driver at a time based on a prewritten rule.

Example rules: price-driven when fee tier change moves revenue at constant volume and mix; volume-driven when notional shifts inside stable fee tiers; product-driven when a share shift across spot, margin, and derivatives moves revenue.

User growth funnel

Acquire, verify, fund, trade, retain. Each account lives in one stage at a point in time. Metrics line up – cost per acquisition for the acquire stage, KYC pass rate for verify, first deposit rate for fund, day-7 trade rate for trade, and 30-day actives for retain. No stage mixes with another, and the set covers the path end to end.

Token research scoring

Utility, security, economics, community, execution. Write measurable definitions. Utility – count of on-chain functions and real integrations. Security – audits passed and material incidents. Economics: supply schedule, inflation, and incentive fit. Community: active addresses, contributors, and social signal quality. Execution: roadmap delivery against dates. A token’s signal goes into one criterion at a time, not multiple, to keep ME. The five cover the sources of durable value for a neutral baseline.

Market structure scan

Liquidity by chain for a stablecoin. Buckets: Ethereum, BNB Chain, Solana, Layer-2 rollups, Other L1. Define attribution rule – count TVL and volumes where the asset settles natively. Cross-chain wrappers follow the chain where finality occurs. Add an “Other L1” cap with a quarterly rule to promote any chain that stays above, say, 5 percent share for two months.

Risk incident taxonomy

Smart contract bugs, private key compromise, oracle failure, governance exploit, off-chain process failure. Each event goes into one type only. A compound incident uses a tie-break rule – classify by root cause after a short post-mortem. Coverage check makes sure operational failures and pure on-chain issues both appear.

These examples keep one axis per level, write definitions in measurable terms, and keep “Other” as a temporary stop. That makes dashboards auditable and decisions easier to defend.

For structure patterns like issue trees that branch MECE from a root question, you might want to see the consulting literature on issue trees and how they organize hypotheses.

Common Mistakes and Fixes

Most problems come from three places: Overlap, missing coverage, or mixed logic. Each has a quick fix.

Overlapping Buckets

Symptom: items appear in two places or cause double counting.

Cause: mixed axes or fuzzy wording.

Fix: pick one axis at a time and tighten definitions with thresholds. Add a tie-break rule so an item that meets two criteria lands in the higher-priority bucket by design. Example: for cross-chain users, assign based on the chain with 60 percent or more of value, then break ties by the latest settlement timestamp.

Missing Coverage

Symptom: a growing set of items does not fit any bucket.

Cause: overly narrow scope or skipped edge-case sweep.

Fix: run a counterexample session and add a bucket only if the pattern repeats. Keep an “Other” bucket small and time-bound. Set a review service-level rule – if “Other” exceeds 5 percent for two reporting cycles, promote the top reasons into real buckets within 72 hours of each cycle end.

Wrong Axis or Mixed Levels

Symptom: first-level buckets mix stages with segments or inputs with outputs.

Cause: eagerness to capture everything in one list.

Fix: enforce level discipline – one level equals one logic type. Stages live with stages. Segments live with segments. If you need both, create a second level.

Do I Always Need to Be 100% MECE?

Perfection can slow teams, even in a consulting process or problem-solving. Use MECE to unlock clarity fast, then tighten only where measurement or governance requires it. In a live market incident, a simple three-bucket split is better than a perfect taxonomy that ships next week.

After the spike, refine definitions and lock them in the dictionary. Aim for useful clarity, not ceremonial rigor. Of course MECE helps, but always apply your best judgement.

Advanced Patterns

You can stack MECE with other tools to guide strategy and focus.

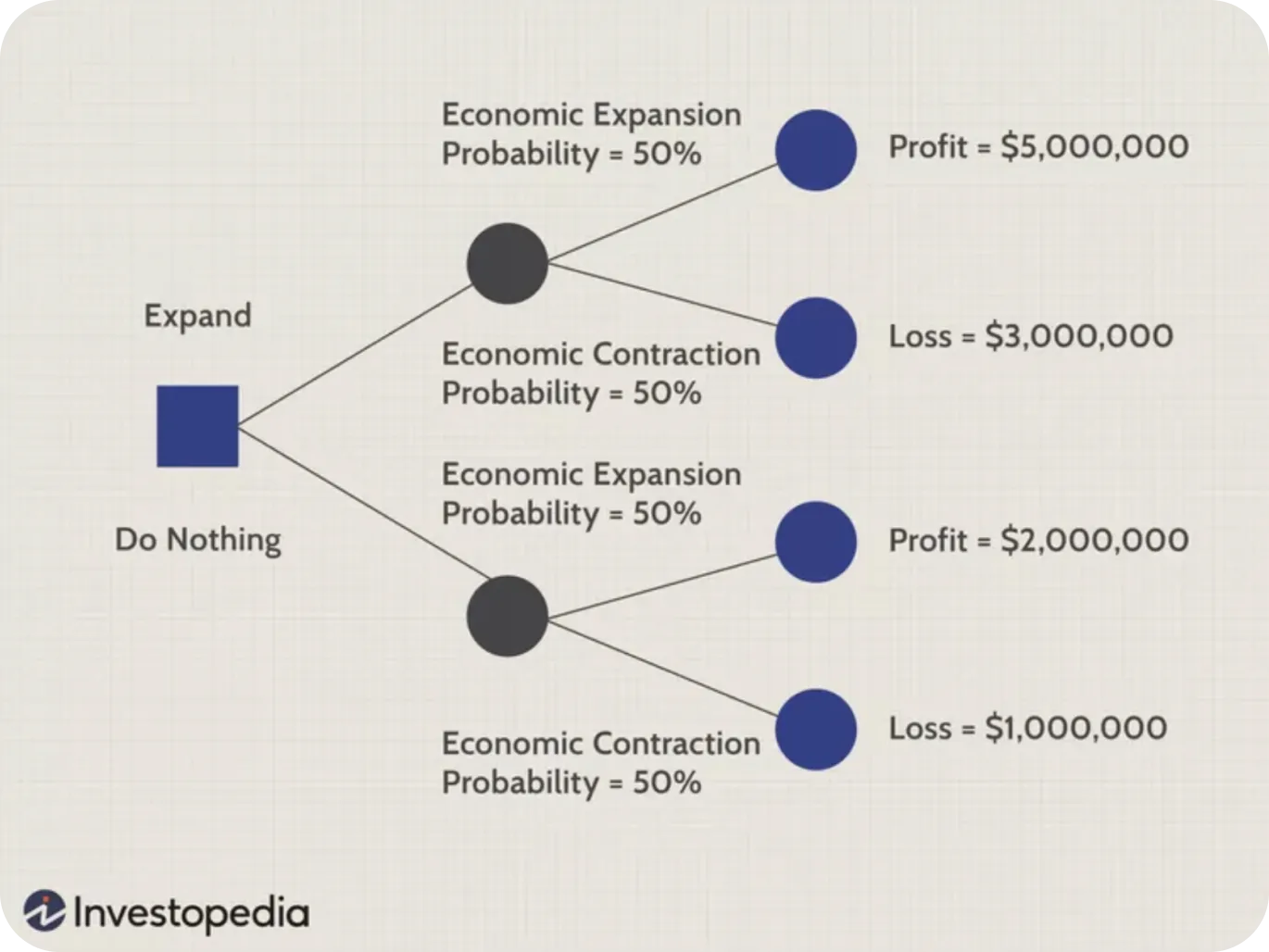

Layering MECE with Hypothesis/Issue Trees

A strong move is to build an issue tree that branches MECE from a root question. Example: “Why did spot volume drop 18 percent in August?” Split into demand, supply, and friction.

Under demand, break into user segments. Under friction, break into price, latency, and failed payments.

Each branch is MECE with siblings, and every level stays within a single logic type. This keeps analysis tidy and tests focused.

Source: Investopedia

There is a simple test to check if your issue trees are MECE: you only have to ask yourself 2 questions.

First, to test if 2 categories are collectively exhaustive, ask yourself: Are there any other conditions that must be true to solve the parent problem?

Secondly, to test if 2 categories are mutually exclusive, ask yourself: Can you change an issue independently from the other issues?

MECE + 80/20 and Prioritization

After structuring, apply Pareto to focus effort.

Look for the smallest set of buckets that drives the largest share of the outcome – volume, churn, errors, or costs. If two segments cause most failed deposits, point your sprint there, not across ten areas.

MECE gives you clean buckets. The 80/20 rule tells you where impact hides.

Toolkit: Checklists and Worksheets

These tools are simple on purpose.

Quick MECE Audit Checklist

Copy and paste this into your doc, then run it on any new structure.

Is the question and unit of analysis written in one line each

Do first-level buckets use a single axis

Can any item fit two buckets

Can every relevant item fit one bucket

Are numeric thresholds or explicit rules stated

Does the sum test reach 100 percent or the full count

Is “Other” small, time-boxed, and assigned an owner

Bucket Definition Dictionary Template

Keep this simple table in a shared folder and update it with version dates.

Bucket name | Definition | Inclusion rules | Exclusion rules | Examples |

<Name> | One-line meaning | Numeric or decision rules that include | Clear rules that exclude | 2–3 real items |

We suggest keeping the table in a shared doc and updating it when rules change.

“Other” Governance Rule

“Other” acts as a guardrail, not a junk drawer. Assign an owner. Review it on a fixed cadence – weekly for ops, monthly for strategy.

Cap it at a small share of the total, like 5 percent.

When it breaches the cap for two cycles, promote the top reasons into named buckets by the agreed deadline.

Round-Up

MECE turns sprawling crypto conversations into structured choices. You get fewer arguments about wording, fewer metric headaches, and clearer priorities.

Pick one question, choose one axis, write buckets, then run the overlap and gap checks.

Pilot on a sample, refine definitions, and publish the dictionary.

The next time your team debates a token list, a funnel drop, or a volume dip, reach for MECE and move from talk to action.

FAQ

What Is MECE Framework in Simple Terms?

MECE means building buckets that do not overlap and that together cover everything that matters for your question. It keeps analysis clean and decisions easy to audit. Many teams treat it as a motto for clear thinking.

How Do I Know If My Categories Are Really MECE?

Run two checks. Overlap: no single item should fit two buckets. Gap: no relevant item should be left out. If either fails, rewrite definitions, add thresholds, or add a bucket thoughtfully.

Can MECE Be Applied Outside Consulting?

Yes. Product teams use it for roadmaps. Analysts apply it to dashboards. In crypto, it helps with token research, market structure scans, and growth planning. The method is domain-agnostic and travels well.

Is “Other” Always Bad in MECE Buckets?

No. “Other” can protect completeness while you learn. Keep it small, assign an owner, and set a review date. If it grows, refactor it into proper buckets using data.

What’s the Fastest Way to Get Started with MECE?

Write a clear question and unit of analysis. Pick the most logical axis. Draft 3–6 buckets. Then apply the overlap and gap checks. Pilot with real items and adjust.