Free Market Economy and Crypto: How DeFi Unlocks True Market Freedom

Key Insights

- DeFi embodies free-market principles like voluntary exchange, price discovery, and minimal intervention, creating open financial systems without centralized control.

- Tokenization and AI-driven tools democratize access, letting anyone invest in real-world assets and optimize strategies previously reserved for institutions.

- Regulatory frameworks are maturing globally, enabling a “regulated free-market” that protects users while preserving crypto’s permissionless innovation.

Introduction

In 2025, decentralized finance (DeFi) has reached staggering heights, with total value locked (TVL) surpassing $400 billion globally. This surge comes on the heels of a historic Bitcoin ETF boom that has drawn institutional investors into crypto markets in droves. Simultaneously, global economic freedom indices are climbing as countries embrace more open financial systems. SimpleSwap observes that these developments reflect a renewed enthusiasm for free-market ideals. Countries with free market economy are increasingly outperforming their counterparts, unlocking greater prosperity and innovation. For instance, the US is often cited as a country with free market economy.

SimpleSwap, a non-custodial crypto exchange supporting 600+ coins, has long championed financial freedom. Its mission is to empower individuals by offering seamless, registration-free swaps. As crypto adoption accelerates worldwide, the relevance of a free market system becomes clearer. This article will explore how DeFi embodies these principles, address common misconceptions, and show how SimpleSwap helps users tap into unprecedented opportunities.

Free-Market Fundamentals Refresher

Before diving into DeFi, let’s take a moment to revisit the cornerstones of a free market economy. The question “What is a market economy?” implies looking into several core principles and characteristics of a free market, what we will do in this section.

Voluntary Exchange

This type of exchange occurs when buyers and sellers trade goods and services by mutual agreement, believing both parties will benefit. Here we talk of private property as exchanged by market participants. As Investopedia defines it, “markets are networks of willing participants seeking mutual advantage.” In a free market system, transactions are driven by choice, not coercion.

For instance, an artist sells a painting to a collector because they value the cash more than the artwork, while the collector feels the opposite. This principle underpins why free market economy countries tend to flourish: millions of mutually beneficial exchanges create wealth and allocate resources efficiently.

Price Discovery

Price discovery is another part of the very definition of a free market. It is the process by which market prices emerge based on laws of supply and demand. When more people want Bitcoin, its price rises, signaling scarcity and attracting sellers. Conversely, an oversupply drives prices down, encouraging buyers.

This dynamic ensures resources flow to where they’re most needed, without central planning. Prices act like signals in a traffic system, coordinating the actions of countless participants. In a free market, which is broadly associated with capitalism, these signals are transparent and adaptive, enabling innovation and efficiency on a global scale.

Minimal Intervention

Here we address broadly and even philosophically a popular question of “What is a market economy regulated by?”. Adam Smith’s laissez-faire philosophy argued that economies function best with minimal government intervention. In planned economies (command economies), central authorities dictate production and prices, often leading to inefficiencies.

Lower level of government regulation (or complete lack thereof) in a free market type of economy adds to the advantages of a free market. Although the majority of world countries are arguably mixed economies and there is now no completely free market. Many things are up to discussion.

In the laissez-faire capitalism, free market systems, by contrast, rely on the “invisible hand” – individuals pursuing self-interest and unintentionally benefiting society. In crypto, this ethos thrives: DeFi platforms operate autonomously, letting users trade and innovate without asking permission from centralized powers. This minimal intervention allows financial systems to evolve organically, aligning perfectly with ideals of a truly free market.

DeFi as a Living Free Market

Crypto isn’t just inspired by free-market principles – it brings them to life. DeFi represents a global, permissionless ecosystem where prices are discovered algorithmically, and central authority is virtually absent.

AMMs & Liquidity Pools

Automated market makers (AMMs) like Uniswap allow users to swap tokens instantly through smart contracts. Liquidity pools replace traditional market makers: anyone can deposit tokens and earn fees as traders interact with the pool. Prices adjust dynamically with each trade, reflecting supply and demand in real time. This system embodies free market dynamics – there are no gatekeepers, and market forces determine prices without interruption.

Permissionless Lending

Platforms like Aave and Compound enable users to lend and borrow assets transparently, with interest rates set by supply and demand. Unlike banks, which impose credit checks and paperwork, these DeFi protocols allow anyone with collateral to participate. This open access empowers individuals globally – whether they’re an entrepreneur in Kenya or a student in Canada. SimpleSwap supports this ecosystem by letting users swap into DeFi-compatible tokens like DAI or USDC, positioning them to earn yield or access credit in minutes. This is financial autonomy at its finest.

RWA Tokenization

Real-world assets (RWAs) like stocks, bonds, and real estate are moving onto blockchains, making investment more accessible. In the first half of 2025, tokenized RWA markets grew by 260%, reaching over $23 billion. This innovation allows users to buy fractional shares of high-value assets – for example, owning $50 worth of a tokenized apartment in Tokyo.

Common Misconceptions & Pain Points

Despite these advances, skepticism remains. Here, we tackle three common concerns about crypto and DeFi, separating fact from fiction.

“Crypto Is Unregulated Chaos”

Crypto’s early days resembled a Wild West, but 2025 paints a different picture. The EU’s MiCA regulation and recent SEC guidelines are bringing order without stifling innovation. These frameworks create a “regulated free market” that preserves openness while protecting users. SimpleSwap enhances security by using blockchain analytics to flag illicit funds, ensuring honest users enjoy seamless transactions.

“Only Speculators Benefit”

The stereotype of crypto as a speculator’s playground is outdated. Bitcoin ETFs have attracted long-term investors, while staking offers steady yields. As of mid-2025, over 35 million ETH is staked, reflecting a shift towards wealth-building strategies. Demographics are widening too, with adoption growing among older investors and emerging markets alike.

Security & Rug-Pull Fears

DeFi isn’t risk-free, but it’s safer than ever. Most major protocols undergo rigorous audits, and decentralized insurance products provide coverage against smart contract failures. SimpleSwap carefully vets listed tokens and educates users about self-custody best practices, empowering them to engage confidently in this open financial ecosystem.

Opportunities Unlocking True Market Freedom

DeFi unlocks practical opportunities for individuals worldwide. Here’s how crypto empowers users to achieve financial independence.

Borderless Yield & Savings

Stablecoin staking in DeFi offers yields that often exceed traditional bank rates, especially in emerging markets. A $1,000 deposit in a local bank might earn 1%, while staking USDC in DeFi could yield 6%–8%. SimpleSwap provides tutorials on how to swap and stake efficiently, helping users harness these borderless opportunities.

Micro-Investments via Tokenization

Tokenization makes it possible to invest tiny amounts in high-value assets. A coffee shop owner could allocate $50 into fractional shares of tokenized stocks or property, building wealth gradually.

AI-Driven DeFi Agents

AI-driven agents are emerging to help users optimize strategies like yield farming and arbitrage. These bots autonomously manage portfolios, bringing sophisticated financial tools to retail investors.

SimpleSwap’s Role & Actionable Guidance

If you consider being a part of the DeFi market, using SimpleSwap is an easy way in.

One-Click Swaps

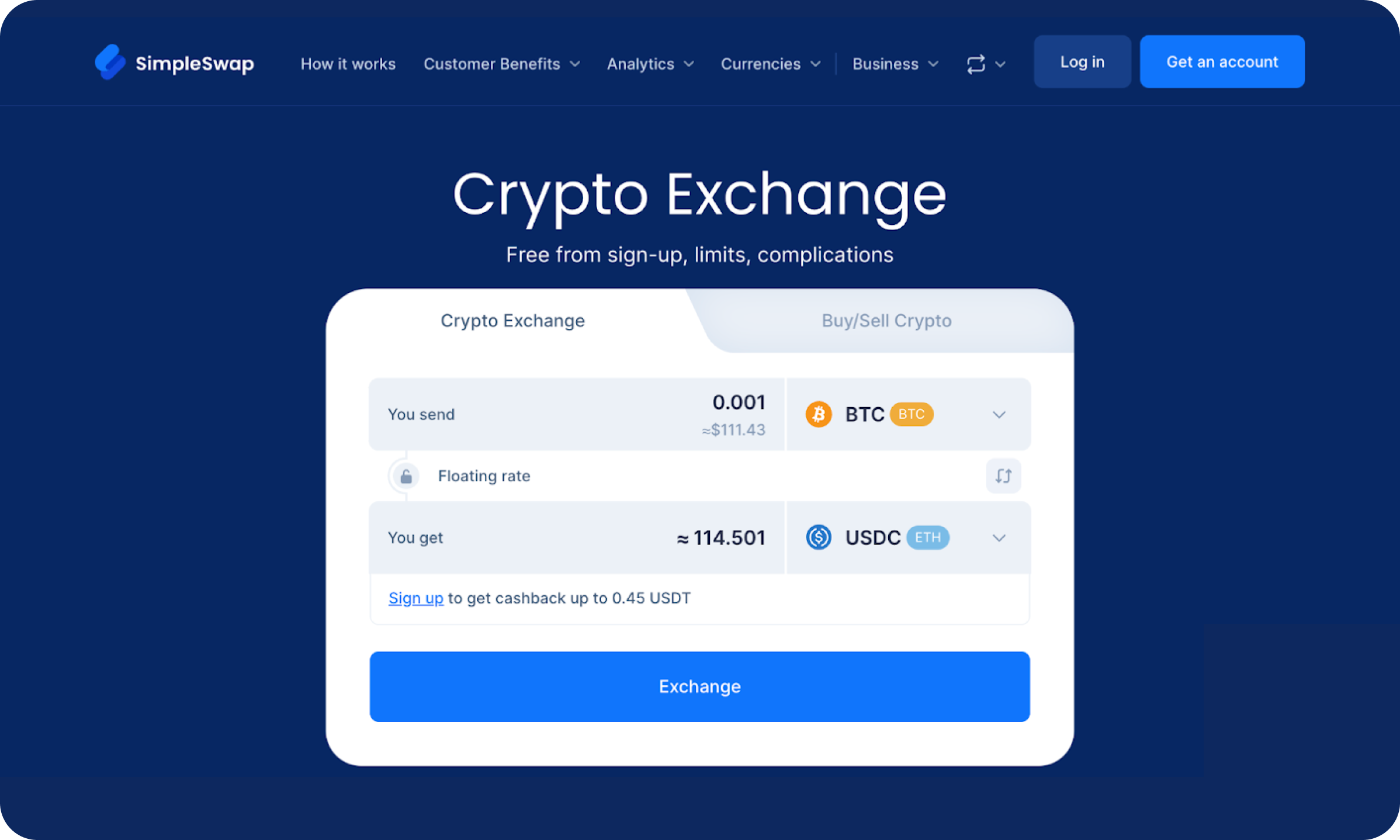

With SimpleSwap, swapping BTC → USDC → a staking pool is seamless:

Choose BTC as the input and USDC as the output.

Enter your USDC wallet address.

Send BTC to the provided address.

Receive USDC and deploy it in DeFi.

The process is fast, intuitive, and requires no account creation.

Security & Compliance Layer

SimpleSwap balances freedom and compliance. Chain analytics detect risky funds, while optional KYC protects users without compromising their privacy. This approach empowers individuals while aligning with global standards.

Educational Resources

SimpleSwap’s blog, academy, and 24/7 support equip users with knowledge to succeed. From beginner tutorials to advanced guides, these resources help users navigate crypto confidently.

Regulatory Outlook & Long-Term Vision

Around the world, frameworks like MiCA in the EU, SEC guidance in the US, and Singapore’s licensing regime are ushering in a “regulated free-market” era for crypto. SimpleSwap supports balanced policies that encourage innovation while safeguarding users. Its long-term vision is a world where DeFi and TradFi coexist, offering seamless, borderless financial services to all.

Conclusion

History shows that free market economies tend to relatively thrive. DeFi brings free market economy ideals to life: voluntary exchange, price discovery, and open access, all the things that make market economy work. SimpleSwap helps individuals leverage these opportunities through intuitive tools and strong security.

Ready to explore? Visit SimpleSwap and begin your journey towards financial freedom in the decentralized economy today.

The information in this article is not a piece of financial advice or any other advice of any kind. The reader should be aware of the risks involved in trading cryptocurrencies and make their own informed decisions. SimpleSwap is not responsible for any losses incurred due to such risks. For details, please see our Terms of Service.